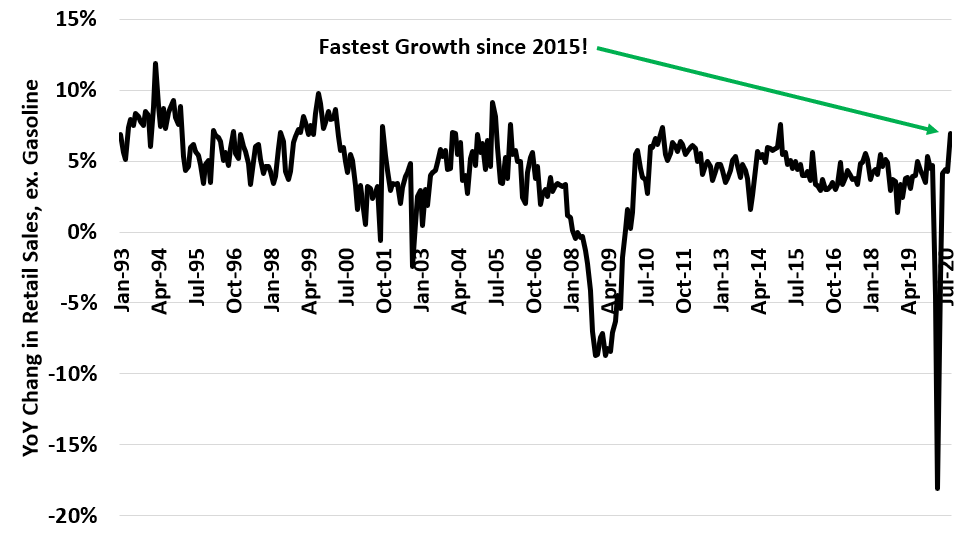

Retail sales announced today… the numbers are incredibly strong. Ex-gasoline (which is usually removed) sales are up 7% (!!!) year over year.

As you can see this is the fastest growth since 2020.

The labor market seems to be fairly week based on jobless claims, but the consumer is roaring right along. Until this changes, the recovery will continue.