Stocks Are Not Cheap Here

Back in March, I posted that I think you’d be better off buying Verizon, Colgate, etc. than buying 10-year bonds at 0.6%. That was fairly close to the market lows.

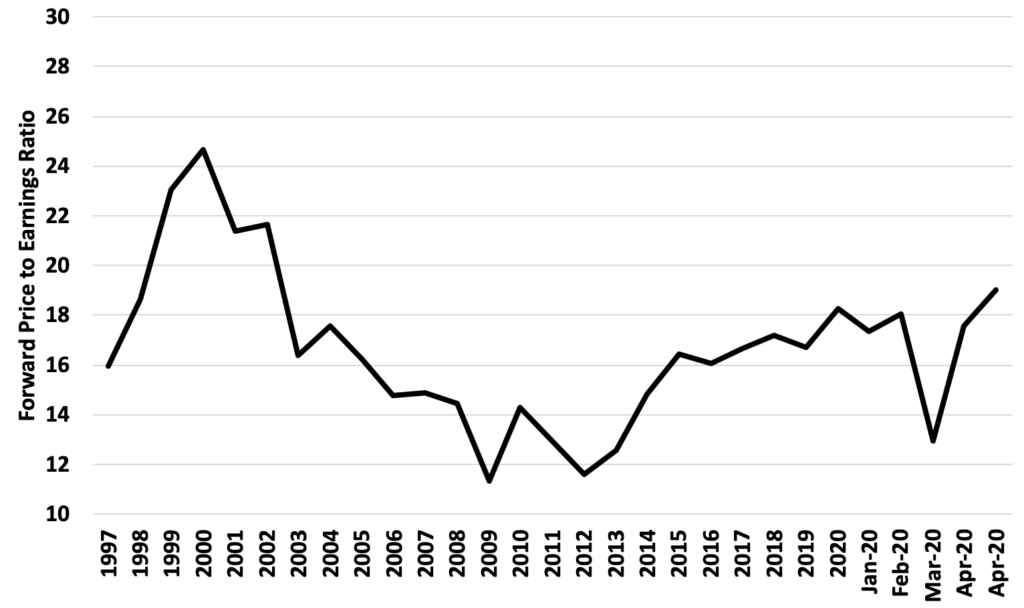

However, the market has rebounded the last few weeks and now seems fairly ahead of itself. Here is a graph of the forward P/E (Price to Earnings ratio). I have a few entries for 2020.

You can see that back in March, stocks were very cheap based on earnings expectations at the time. However, stocks are up about 30% off their lows and earnings expectations have declined considerable and so now stocks are at their highest forward P/E since the tech bubble.

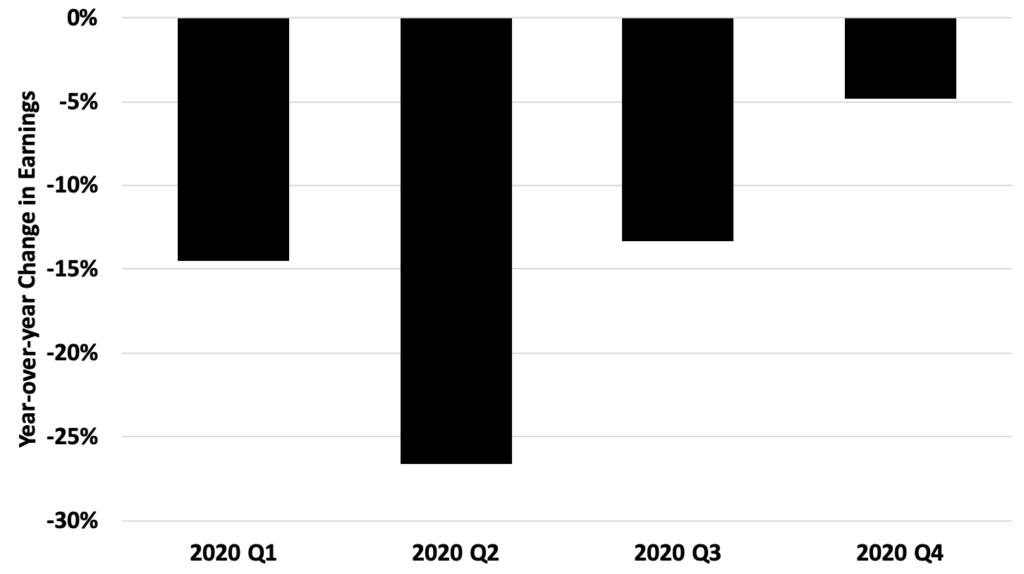

And I think these expectations are still way too high. Look at the expectations for the change in earnings across quarters.

Analysts are expecting almost a full recovery in earnings by Q4. I’ll take the under on that.