And on the 7th Day, the Bitcoin God Rests

One of the most important books for new investors to read is “Random Walk on Wall Street.” It says stock returns are random. Bitcoin returns? No so much… Sell on Saturday and buy on Monday.

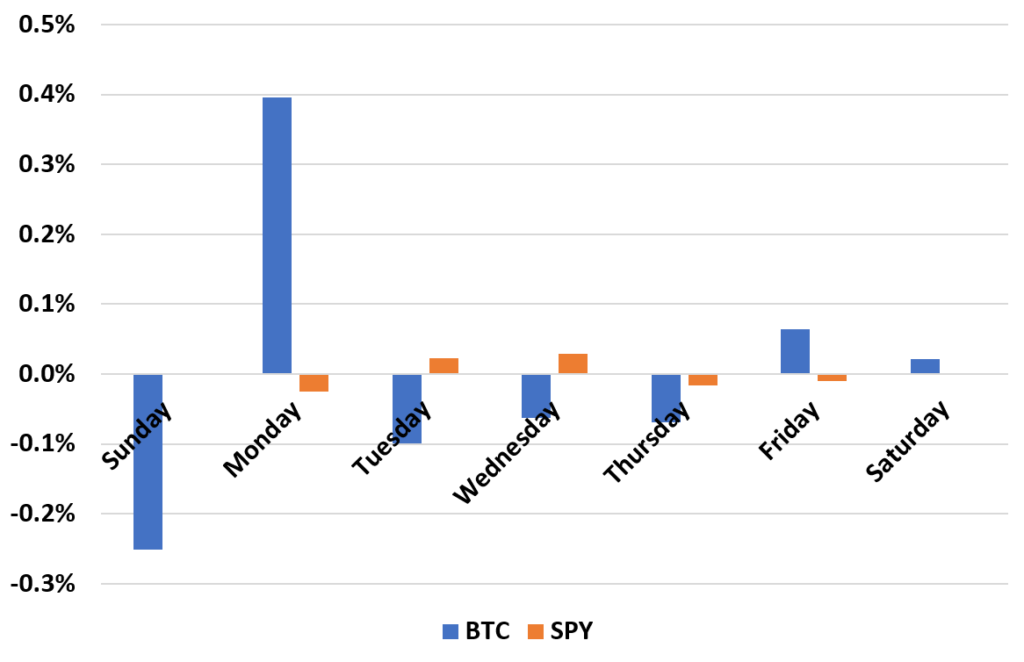

This chart shows the average excess return by day for Bitcoin and the SP500 (represented by SPY) since 2014. On average, each week, if you shorted BTC on Sat night, covered on Sunday night and went long, and sold on Monday, you would have made a profit of 0.65% per week.

One of the biggest differences between Bitcoin and stocks is the Bitcoin market literally never sleeps. Christmas? It’s trading. Sundays? It’s trading. Super Bowl? it’s trading. New Years Eve? It’s trading.

But the problem is almost no one is going to trade 24/7 all year long. They will take a day off. And who is going to hold Bitcoin if they aren’t paying attention when it’s average daily move is 3% and 10% moves aren’t uncommon?

Thus, you see a clear pattern: sell Saturday to take off Sunday and start the game again on Monday.

(You see a little pattern for stocks – a lot of that has to do with information release schedules but it’s tiny compared to BTC.)