Most people today are focused on the 4 million job number. I’ll note that the 11.1% unemployment rate is still worse than any point during the great recession.

The more concerning part is a. the continued growth in permanent job losses and consistent initial claims and now continuing claims.

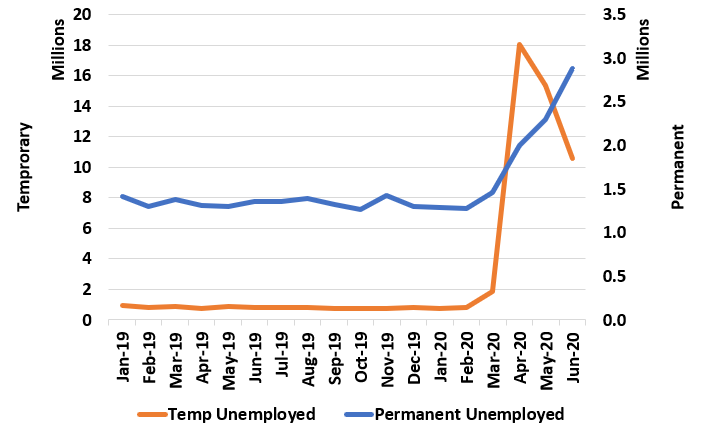

Here’s a graph comparing the number of unemployed persons on a temporary and permanent basis.

While temporary layoffs have been reduced, some of that is because they have become permanent layoffs. These will be much more difficult to recover going forward.

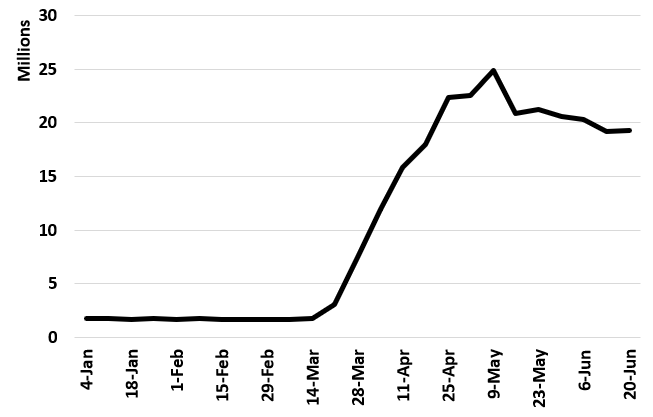

Not only that but continuing claims, which has fallen almost 5 million from the peak has stopped declining.

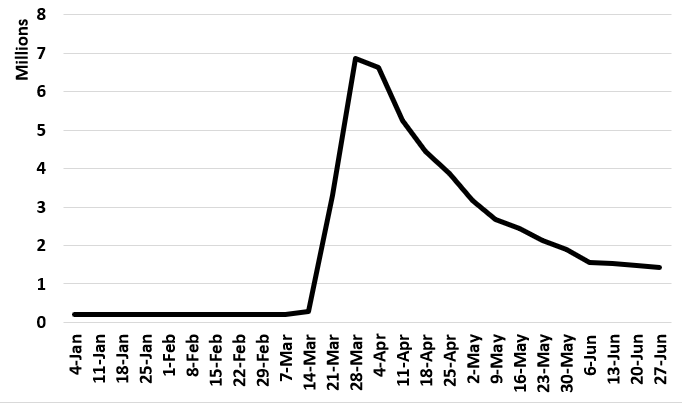

And new claims is stuck at 1.5 million a week. Which sounds better than 7 million a week, but is still 2.5 times higher than ANY point before COVID-19.

The bottom line is this is a good report. Future reports may not be as rosy.