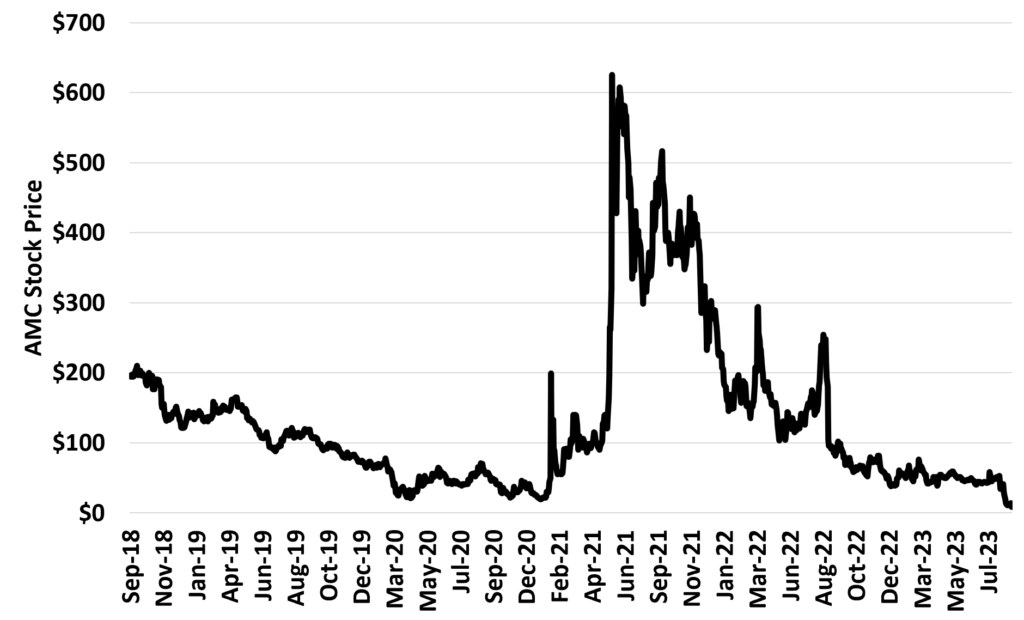

The meme stock phenomenon started over two years ago now. One is gone (BBBY) and the next one is about to go – AMC. Here’s the five year chart.

The stock price is now at an all time low. Just imagine how much the “diamond hands” have lost on this stock by not asking the simplest question of all:

Is the movie theater business better today than in 2019? And the answer to that is a resounding no. Ways to watch movies have forever changed. So there was no reason for AMC’s stock price to be better than it was in 2019, regardless of any short interest or squeezes.

This chart shows you a lot of important things: 1) stock prices in the short-term can be irrational for a long time but 2) time is undefeated.