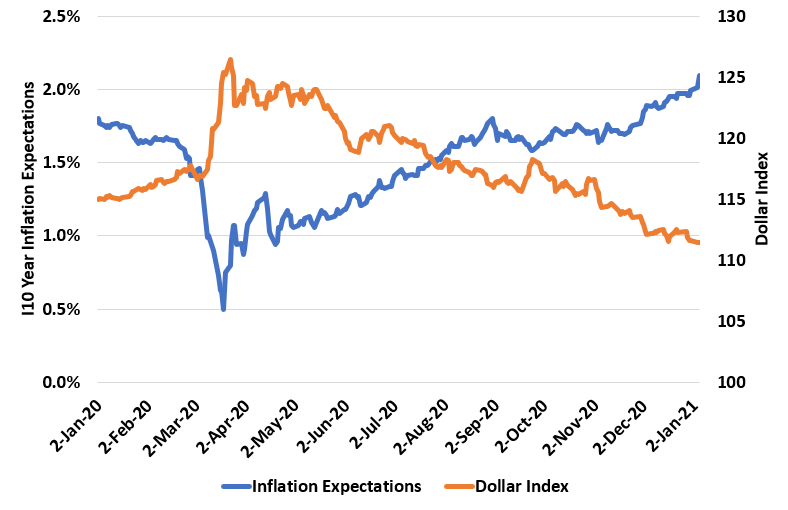

With the Democrats winning the Senate last night, the 10 year yield is above 1%. Why? Not because of real growth expectations. But because of inflation expectations. They are higher than when we started the year (see the blue line)!

How does this link with the Dollar? Inflation means the dollar loses purchasing power. All else equal, that means that the dollar will be worth less than other currencies.

You can see in this graph that inflation expectations and the dollar are mirror opposites of each other.

I expect this trend to continue this year – it may be a good year for foreign investments relative to the US.