As I mentioned previously, end of the year – aka the “Santa Claus Rally” – is the best time of year to be invested in the market. The question is… has the market figured that out already?

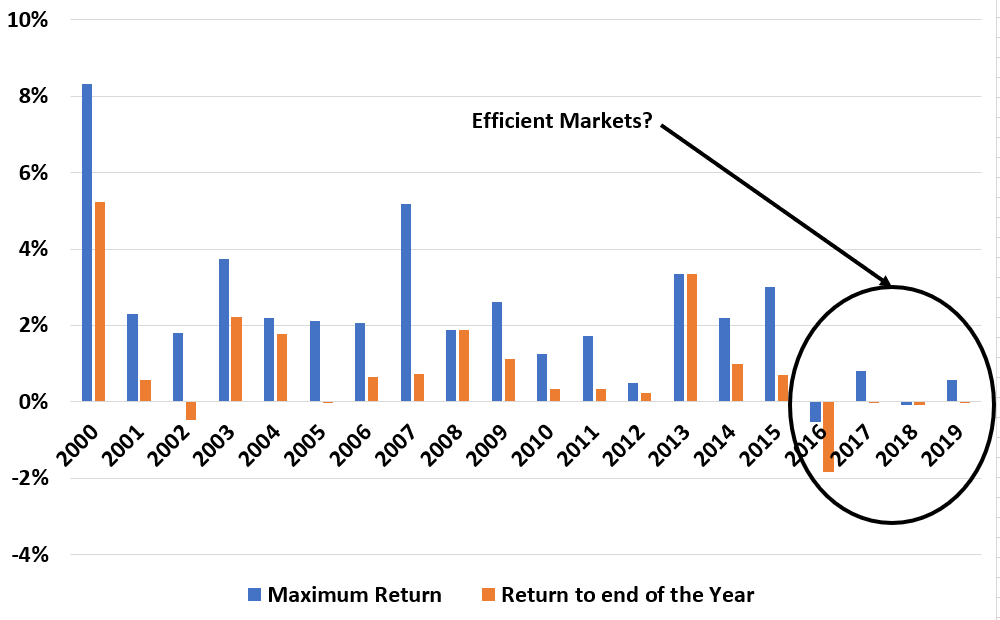

Here are the returns for the IWM ETF (Russell 2000) from 3 trading days before Christmas to the end of the year. I have the Maximum return as well as the holding period return from 2000 to 2019.

You can see massive returns during this period. The annualized holding period return is ****31%****!

You can see this has almost disappeared over the last few years. The average return the last 5 years is negative. The average return over the last 10 years is 0.4% or 13% annualized – worse than the 14% the market has averaged over this period.

The bottom line is it appears the market has become more efficient about the Santa Claus Rally. i.e. people anticipated it so they buy stocks beforehand, pushing up the prices and therefore lowering returns.