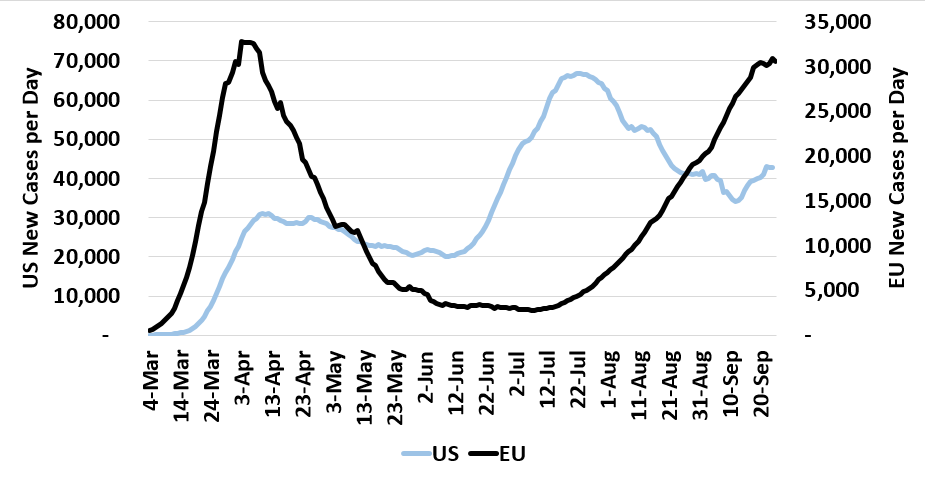

It’s been a long time since I posted COVID data. Here is the current 7 day averages in EU and US.

Here is the US cases are beginning to rise again after making progress. This could be related to Labor Day weekend activities. The EU is close to square #1 again.

Bottom line is COVID has the ability to cause significant economic disruptions going forward, especially as we move indoors when the weather declines.