Beyond Expense Meant You Should Have Looked Beyond Meat

Beyond Meat is a perfect example that price matters. Weeks after it IPO’d it was at $240/share. I told people it was too expensive. And yet I got endlessly mocked. Well, 3 years later, it’s given you a nothing burger.

In July 2019, Beyond Meat IPO’d. It had $87 million in sales. It had the best technology. It was amazing blah blah blah. They were going to partner with McDonald’s, and Burger King, and In n Out Burger, and Aliens, and Bitcoin and whatever else the fans could come up with.

But there was just one problem. Beyond Meat is just another food supplier … and a meat substitute. There isn’t any “new” market for their product. They would just replace real meat or maybe some raw veges instead.

Yet, the value of this company was close to $16 billion! Yes that is **184** times sales. It was worth almost as much as Hormel, which had close to $10 billion in sales.

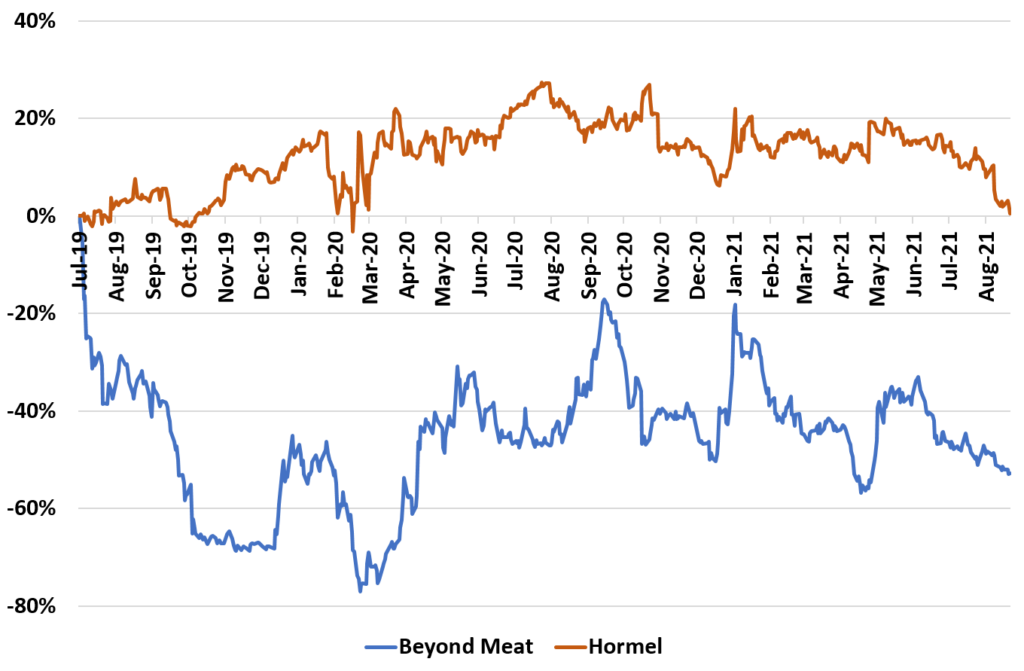

So over the next 3 years, Beyond Meat is down 50% while Hormel is flat even those its sales are up 400% and Hormel’s sales are flat. It doesn’t matter. People realize now it’s just another “meat” supplier.

The reason I say this is many people are excited about many stocks these days that are insanely expensive. Tesla is one of them. Be careful… price matters.