Lots of talk that we are already in a recession because we’ll likely have two quarters of negative real GDP growth in Q1 and Q2. I don’t think people know what the word recession means.

First, two consecutive quarters of negative growth isn’t even a NECESSARY condition to have a recession. Please note in 2001 we had a recession but NO quarter had real negative growth.

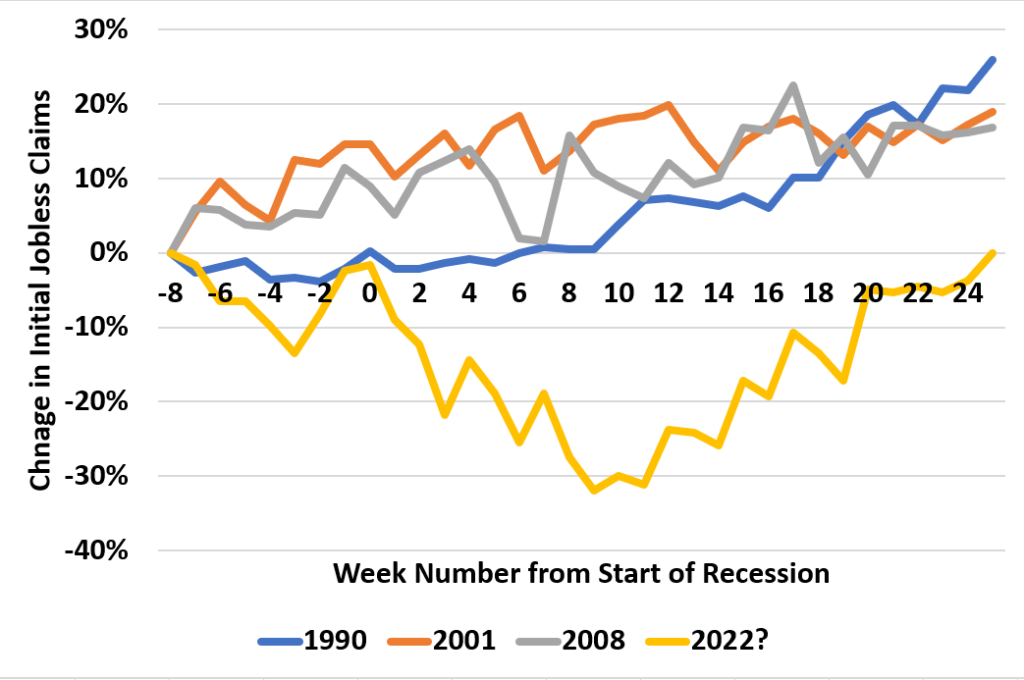

Second, the labor market is just too hot still. Just to show you, here is a graph that shows the change in initial jobless claims from 8 weeks before the date the recession started to 6 months after. I plot exclude the COVID recession because the numbers are off the scale.

This year looks nothing like the last 3 recessions. Never do initial claims decline into a recession. In fact, we are back were we were 8 months ago.

Are things softer than 6 months ago? Absolutely. Is real GDP going to be negative? Absolutely. But this isn’t a recession in the official sense.

It also points to how crazy tight the labor market has been. If we are in a recession, the labor market is so strong it hasn’t shown it.