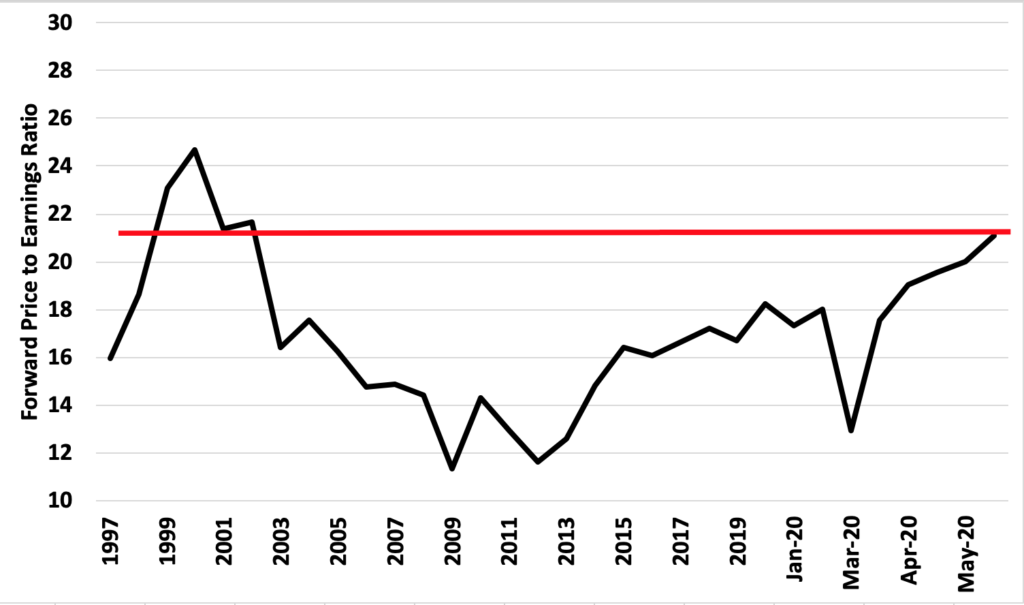

Another week has gone by. The market is up, earnings estimates are down. Here’s an updated graph for Forward Price-to-earnings ratio, where you can see we are partying like it’s 1999.

You can forward P/Es continue to increase. This is because the market is increasing, all be it not that much. The real issue is that earnings estimates for the year continue to decline. Expectations are earnings for the year will now decline 20%.

The bottom line is this market is not cheap on a P/E basis.