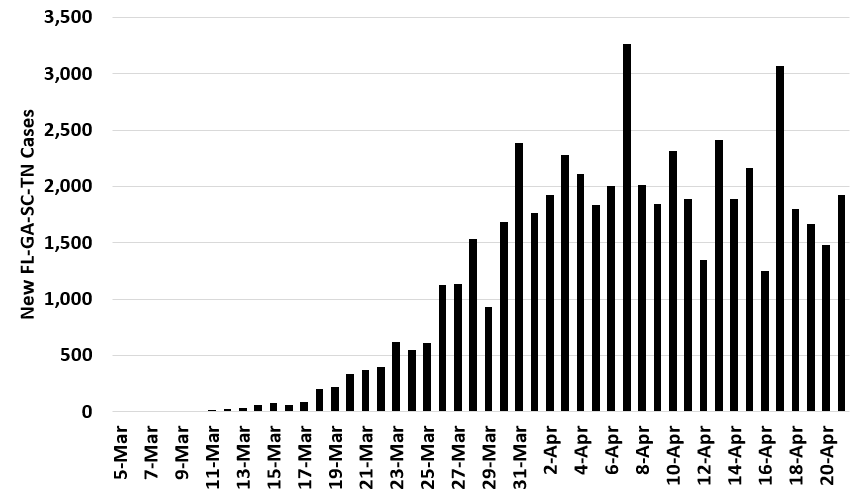

One of the big concerns about reopening is we are going to have a ‘second wave’ of coronavirus cases. It seems fairly obviously that cases would go up, especially if we don’t have the proper amount of testing.

The good (?) news is that 4 states are started or will start to reopen soon:

- Florida has reopened some of its beaches

- Georgia plans on just about a full reopening by the end of next week

- South Carolina is opening many stores and beaches

- Tennessee will open most counties Monday

One issue is these states still have a pretty high case load even as of yesterday:

We can use these states to track what the case load does after the reopening begins. Additionally, we will be able to see how much of the economy improves on reopening, especially in Georgia. They will open restaurants on April 27th.

It’s also worth noting that Atlanta’s airport is the busiest in the world.