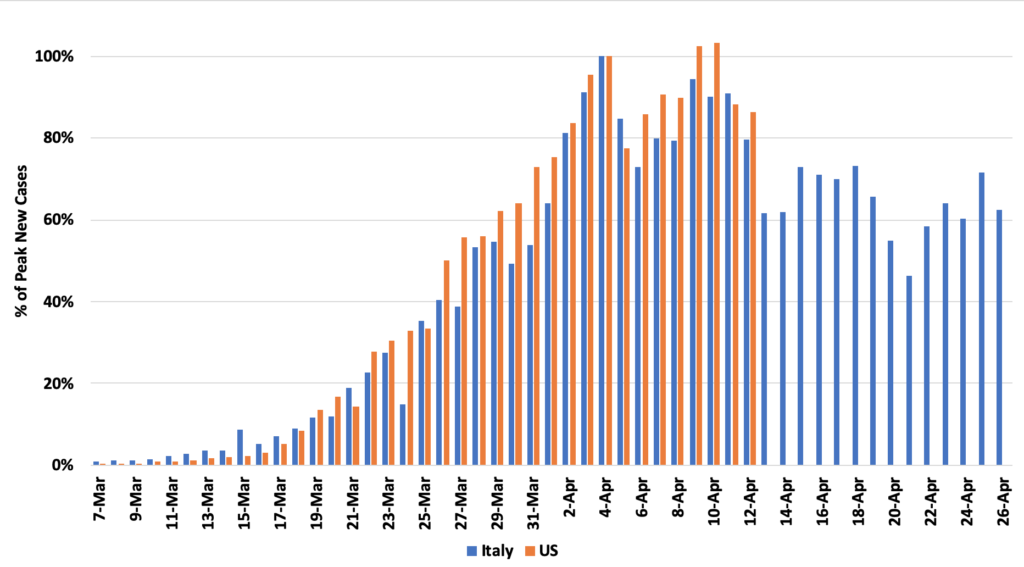

As I have posted for weeks, my baseline model is that the US will follow Italy’s model. We are still a long way from being to reopen based on the current criteria of governors.

As you can see through yesterday, the comparison matches.

We are running about two weeks behind Italy when it comes to the peak. Presuming we follow Italy’s path, we will still be at a high level of cases in two weeks.

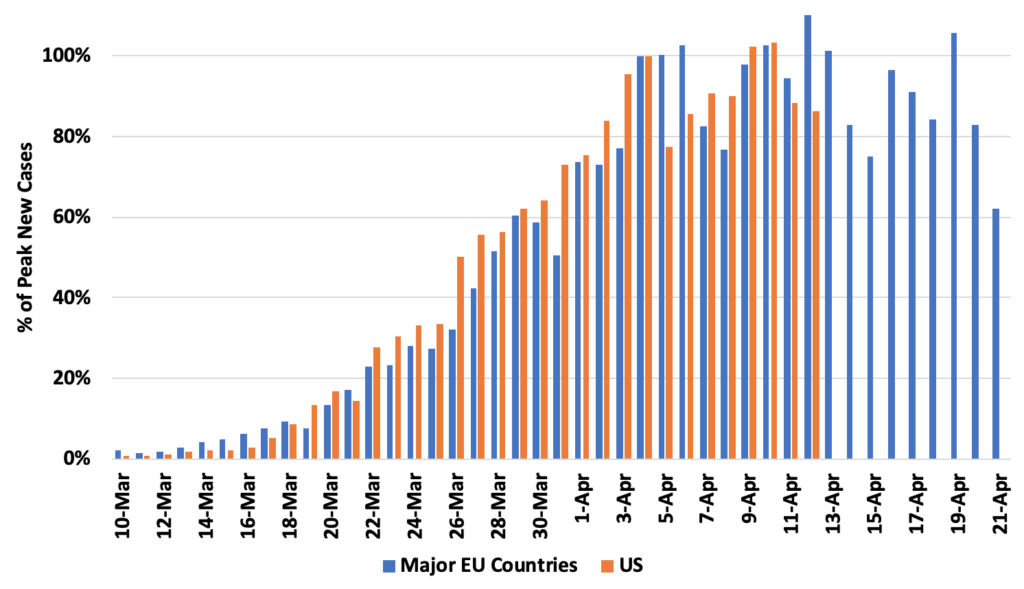

Another example if if we compare to the EU overall. If you think about Italy as say a NY and the rest of the countries as States, that could be a good comparison. If we match peaks, here is the EU. (France had a weird day so I cut that off.)

We are about 9 days behind the EU. Please note that big drop at the end looks impressive, but that gets them to 61% of cases at peak, 18 days after it happened. Italy only took 9 days to have that same drop and of course Italy is still at 61% of cases.