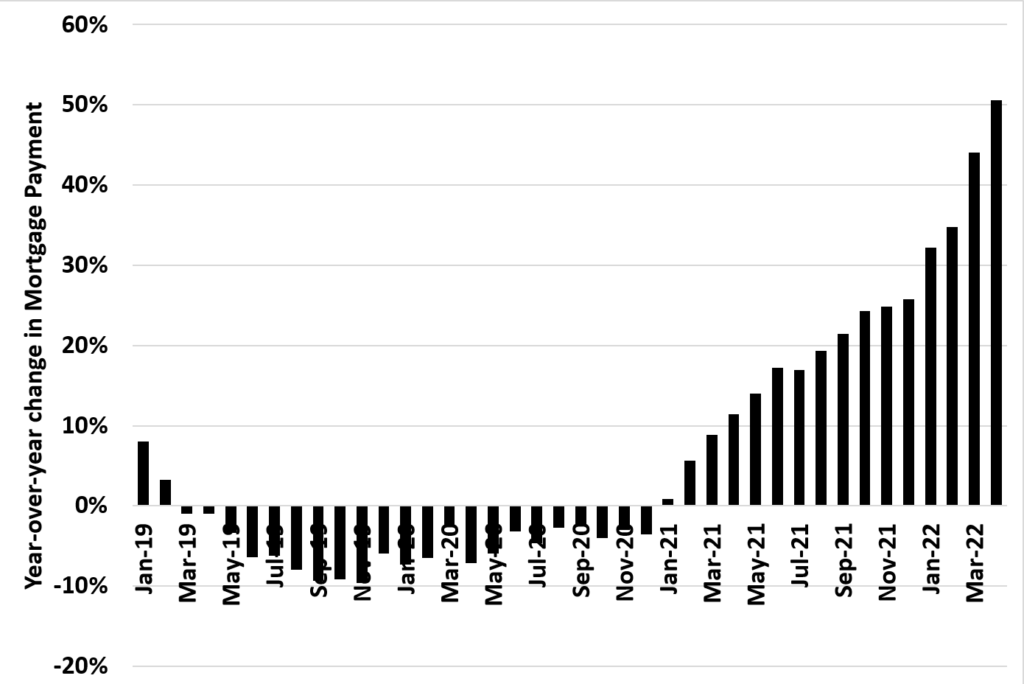

While we have been focused on things like oil, used car prices, etc. perhaps the biggest price increase over the last 12 months has been in housing. While home prices are up 20%, that truly understates the price increase to buyers.

In this graph, I show the year-over-year change in the payment for the average priced home. There are two pieces that drive the change: 1) home prices themselves and 2) mortgage rates.

When the pandemic started, housing prices increased but the decreased mortgage rates made housing actually cheaper on a monthly payment basis compared to pre-COVID.

However, now payments are up over 50% year-over-year as mortgage rates touch 5% and home prices are up 20% year over-year.

This large increase will certainly have an impact on demand, especially institutional demand which has been almost 1/2 of purchases in a lot of markets.