The jobs report came out today. The 199k job growth was WAY below what the “expectations” were. But those expectations were a joke. There is no way to grow our economy 800k jobs at 4.3% unemployment.

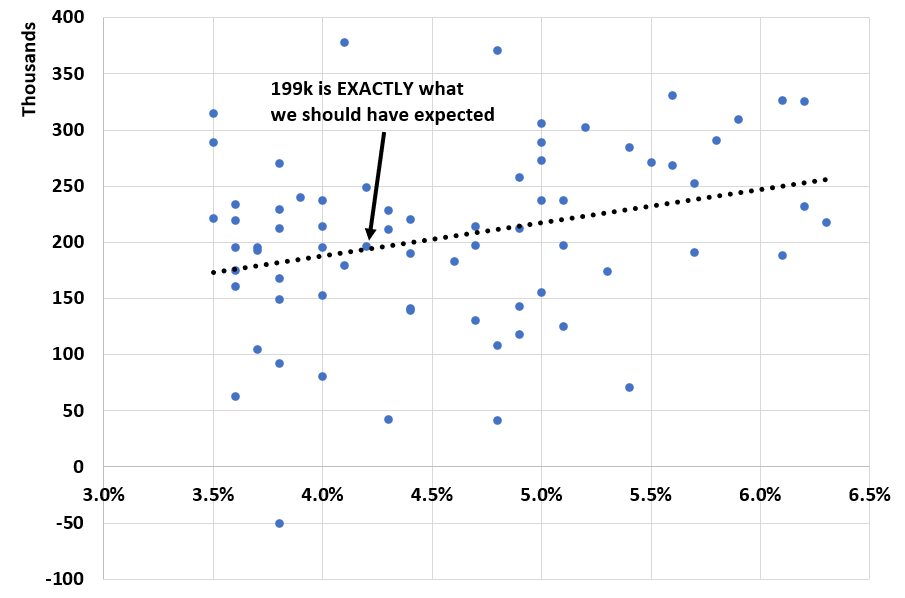

Here’s a dot plot from the last recovery (2010-2019) when the employment rate was under 7%. The y-axis is payroll growth and the x-axis is the unemployment rate.

As one would expect, as unemployment goes down, payroll growth slows. This is simple math: the less unemployed, the less payrolls can grow.

At 4.3% unemployment – which is where we were last month, the linear trend would say our job growth would have been … 195k jobs. Right what we had.

We are running out of workers. We are now only 0.3% away from the lowest unemployment of the last cycle.