As expected, the Fed discussed a much more aggressive tightening schedule over the next few months than was thought a few months ago. The stock market rallied on the news, but interesting the bond market move was bearish.

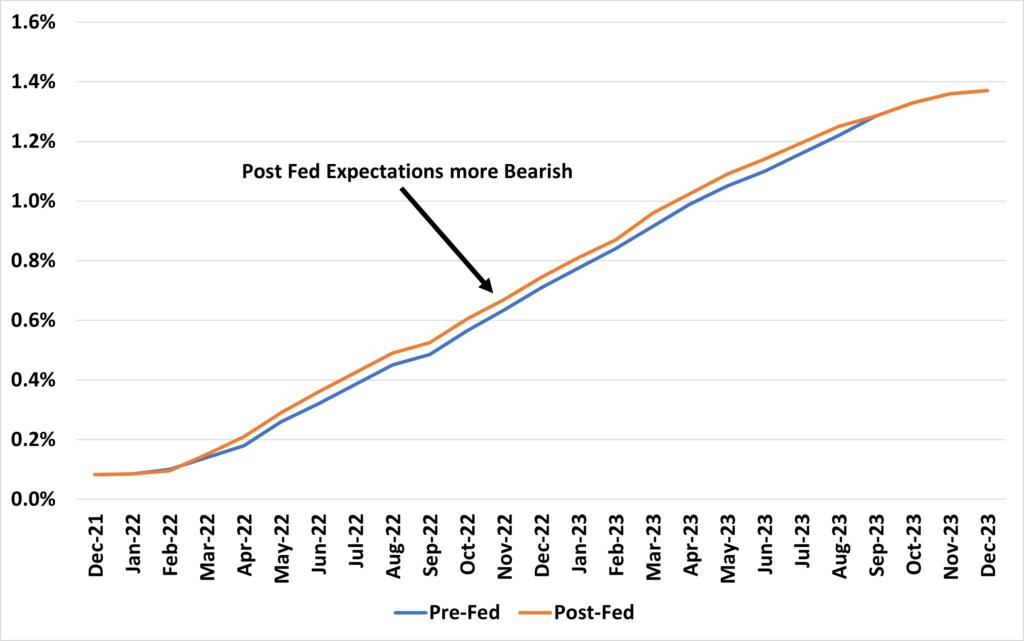

Here’s a chart look at Fed Funds Futures pre-announcement and post-announcement.

You can see the market now has a slightly faster expectations for Fed tightening – probably not too much difference, but it’s interesting to see the market rally when the news was either expected or slightly worse.

The bottom line is if we get 3 Fed hikes next year, the asset pricing market ultimately will not be happy.