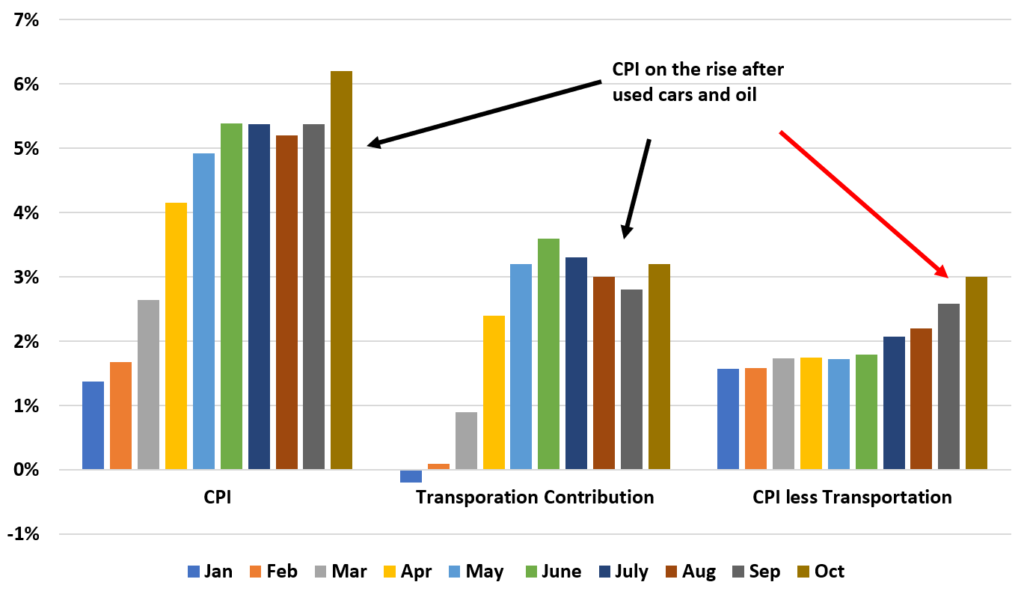

October CPI came out today and boy it’s hot. Overall at 6.2%. Removing used cars and oil (which is still only 1/2 what it was in 2007), CPI is now at 3% YoY. Importantly: The market sees a Fed raise in June now.

As I discussed last month, the issues that plague the supply chain are not going to be fixed quickly. Rent will also cause a positive increase in CPI the coming year.

The Fed is going to have to act sooner than they think. If inflation continues this high, maybe even BEFORE June. And once the Fed acts, the party that is risky assets will end soon after.