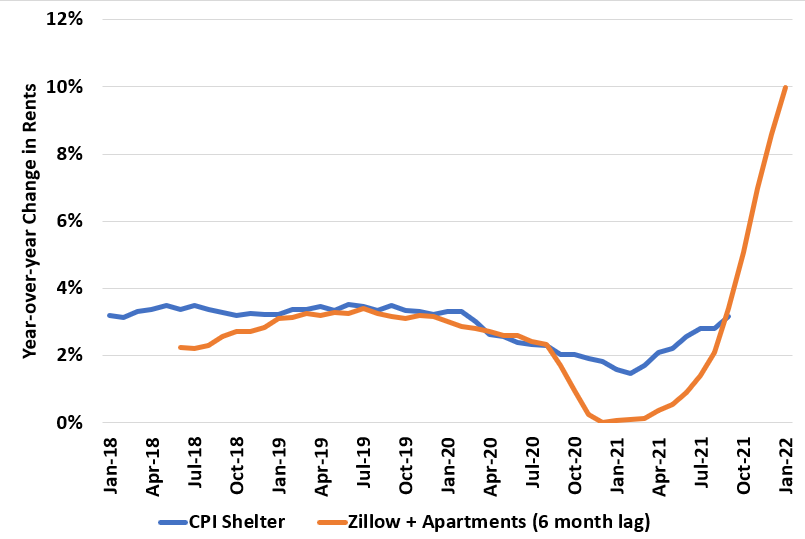

The CPI story for 2022 is going to be rents. “Shelter” or what is also called “Owner’s Equivalent Rent” is going to rise rapidly over the next few months and it makes up *32%* of CPI. Here’s some data to show why.

Below is a graph of the year-over-year rent increases through CPI and then using an index from Zillow and Apartmentlist.com.

Note that the index from Z/A is more volatile because it is current changes in rent. Most people are locked in their rent for a 12-month period. Thus it takes up to 12 months (or more) for current increases to be fully baked into all rents. So I’ve lagged the price changed by 6-months.

You can clearly see the dip in both and now the rise. For sure the next few months are going to see an acceleration in CPI Rent, which is going to push up core CPI even if Oil and used cars slow down in price increases.