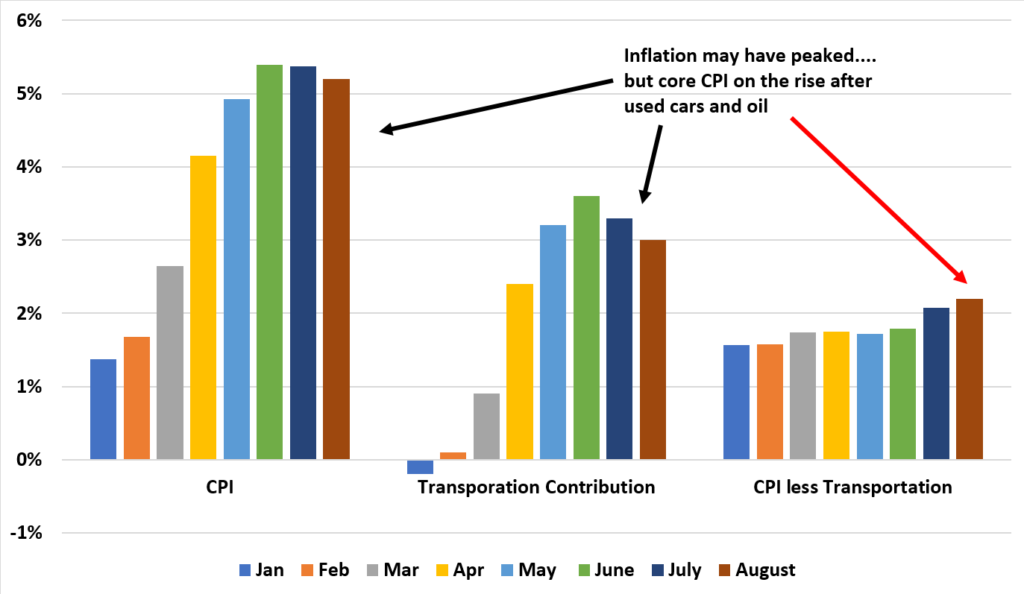

The headline inflation numbers were better than expected and year-over-year inflation is slowing. But CPI outside transportation is still rising.

Most of the growth in inflation from January to June was just used car prices and oil. Used car prices are due to a supply issue, not a money printing issue. Oil is just reinflating.

But now, transportation is starting to cool and therefore CPI outside of that is starting to slowing rise. At 2.2% year-over-year, it’s not a big issue, but something to slowly watch.

Regardless, I don’t expect this will alter the Fed’s plan to start to Taper later this year.