That is the number of crypto tokens created over the created over the last 8 years. Yes, One-hundred eight-three trillion, five hundred twenty-two billion, nine hundred sixteen million, five hundred four thousand, five hundred thirty-four.

But you are saying “Hey Chris, DOGE is only worth $0.001 $0.75 $0.38 $0.48 while Bitcoin is worth $44,000 so they aren’t all worth the same.

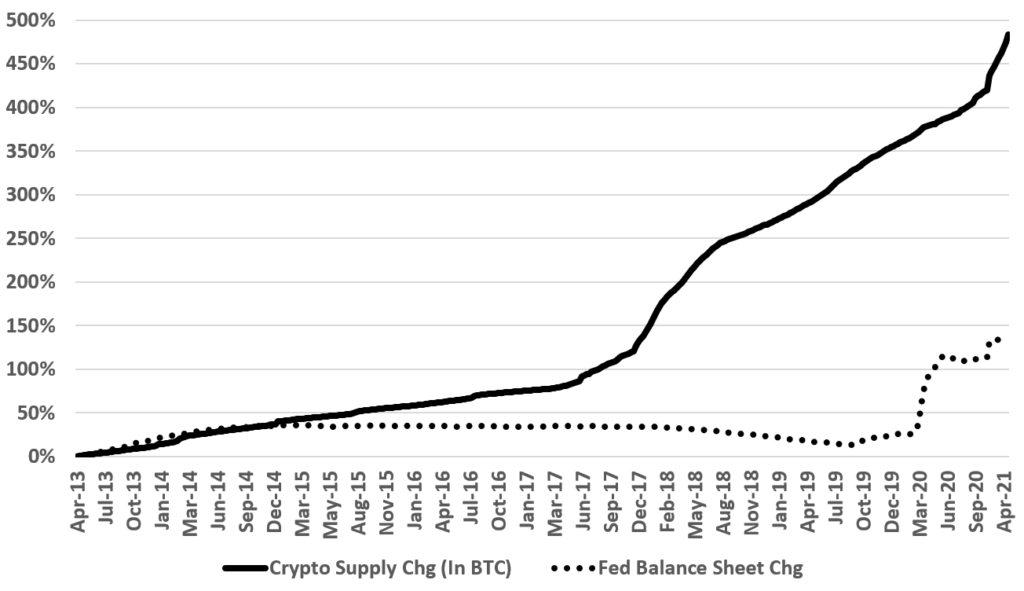

Well, let’s convert them all into Bitcoin equivalent. Each week I calculate the change in supply for each crypto and multiple it by the ratio of its price to Bitcoin’s price that week. I then compart the increase in Bitcoin equivalent crypto to the change in the Fed Balance Sheet. You know, that terrible, awful, debasing, dollar destroying institution.

The supply of crypto is up almost 500% during this period whereas the supply of dollars is up 140%.

While you can’t make more than 21 million Bitcoins, you can make an unlimited amount of many cryptos – including Etherium and Dogecoin. And of course an unlimited number of currencies.

I expect that cryptocurrencies will be about as value as those baseballs cards I used to collect … along with every other kid my age. It’s simply economics: Unlimited supply = $0 value.