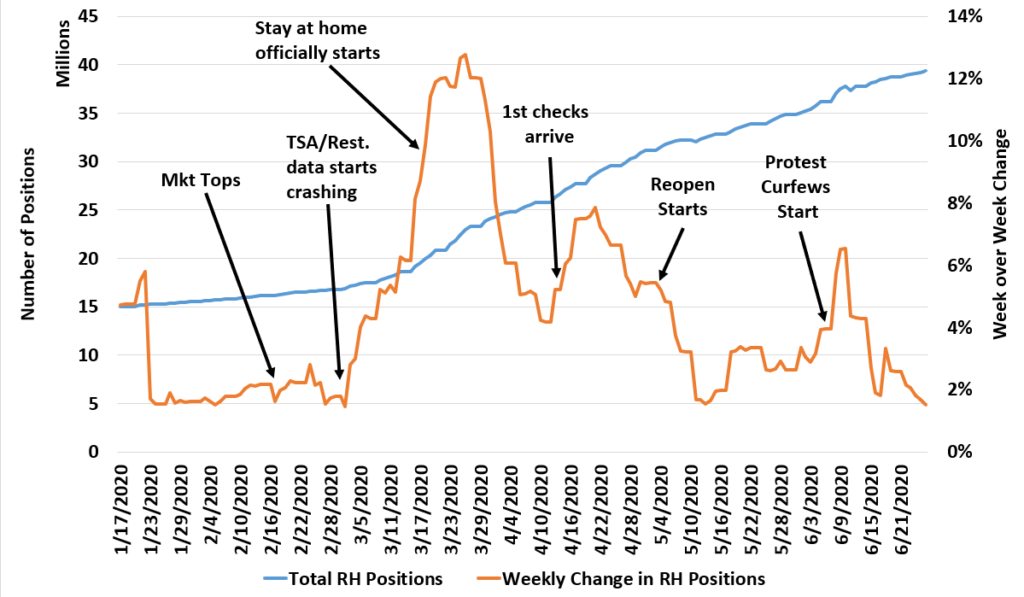

I posted this before, but this is one of the biggest reopening question marks for financial markets: What will happen to retail investors? This graph shows the week over week change in Robinhood positions for the 1st half of 2020.

Robinhood grew almost 200% over this 5 month period!

Why? Was it gambling? Nope.

Was it RH users called the bottom? Nope.

The correct answer? People were bored and had nothing else to do.

The big increase in users started when TSA and Restaurant data started crashing. You can see it declines when reopening starts and then picks up again when the protest curfews started.

Basically, people used Robinhood to entertain themselves.

The big question for a lot of these small retail loved stocks: What happens when people have other things to do? My guess is they will be at Disneyland instead of trading.