After last month’s CPI, I asked you if you believed in miracles. The market was all excited the worst of inflation was behind us. However, as I pointed out, the core pieces of inflation continued to get worse. This month? Miracle over.

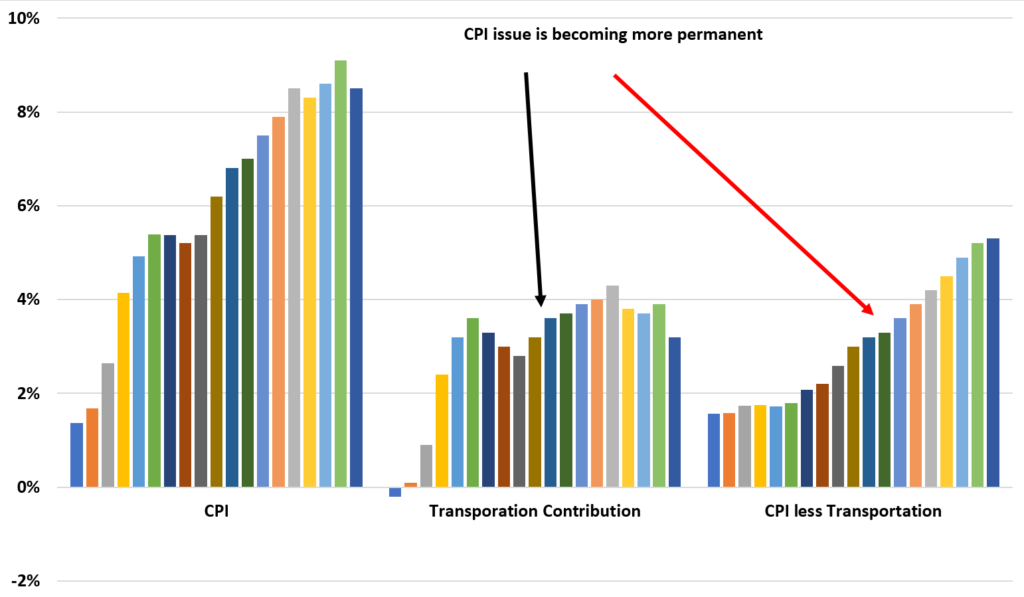

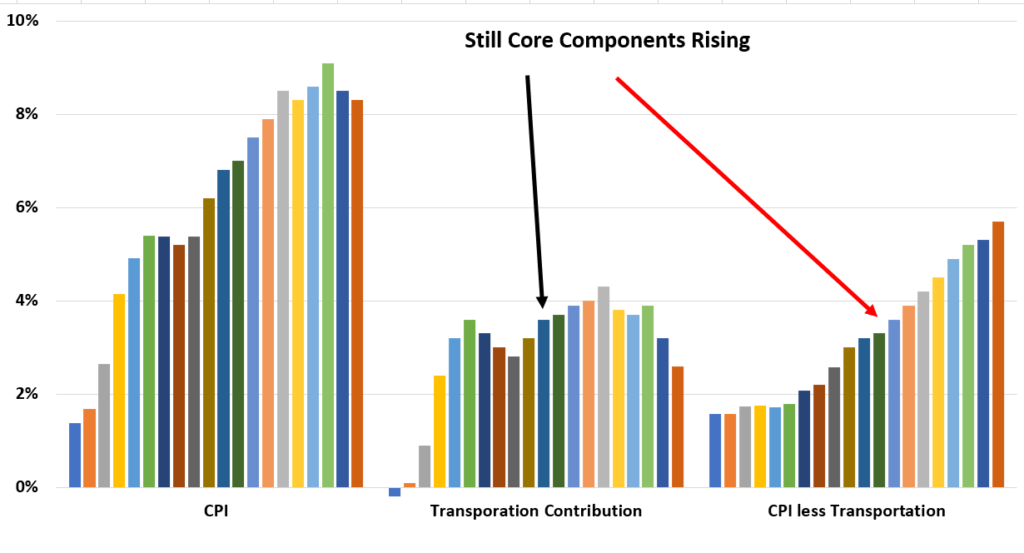

You are all probably getting sick of seeing this graph, but here it is again This is CPI broken into the part that is due to used cars and oil and then everything else

You can see things like gas and used cars are seeing prices decline year over year (soon they will be negative). But everything else? We are now approaching 6% year over year.

And next month? Shelter will be worse. Food isn’t getting any cheaper. There is no reason to think this component will go stop going up let alone go down.

Ultimately, as I have said for months, the Fed is going to have to continue to raise rates here. Inflation is baked into the system. And per usual they are going to go too far and we are going to have a real recession. Don’t worry. That will just be “transitory.”