Either Bonds or Stocks are Spectacularly Wrong

Right now in financial markets, stocks (well at least 6 of them) are acting like there’s zero chance of a recession. The bond market is signaling there is going to be a big recession. Both can’t be right. I’d bet on the bond market.

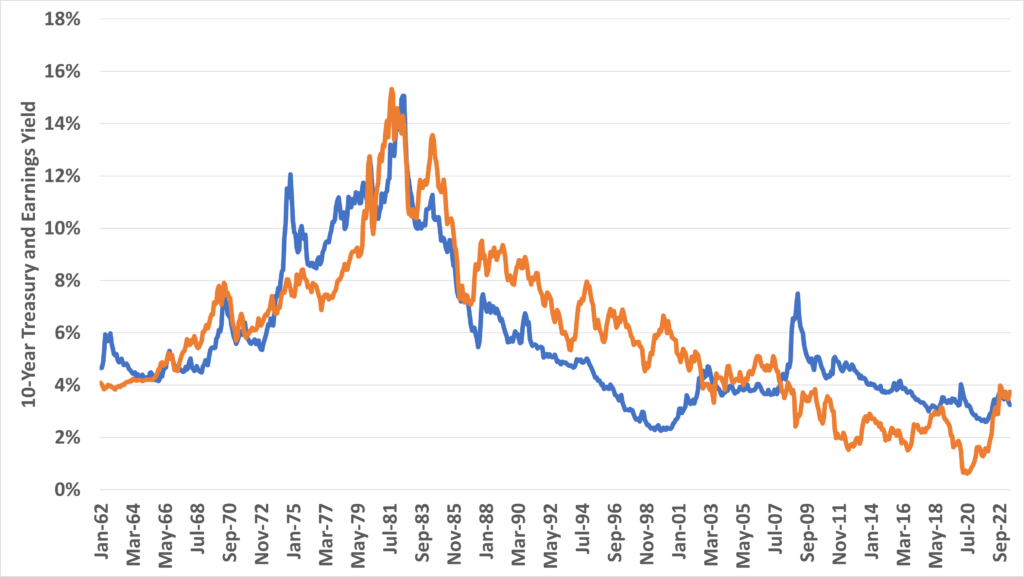

There’s a lot of reasons for that opinion, but I think sometimes it’s important to remember these two asset classes (and consumption) are competitors for your dollars. To show you this is the case, let’s check out the relationship long-term comparing the 10-year Treasury yield to the Earnings Yield (earnings/Price) on the S&P500.

Note how closely these two lines follow each other over time. Why? Well right now if the 10-year was yielding 15%, I’m pretty sure all of us would dump a lot of equities and buy bonds. That would push yield down on bonds and push prices down and earnings yield up on stocks.

In other words, there is an equilibrium between stocks and bonds. Note when this equilibrium goes out of whack, it’s generally a good time to buy (sell) one asset. For example, in the late 1999s “safe” bonds” were offering a 4% higher yield than stocks. In 2008, stocks were offering 6% more than bonds. Same during March 2020.

The issue this year? Well, stocks are up close to 20% and bonds yields are … also up. Note that earnings haven’t been going up so you can see instead of the earnings yield being 3% above Treasury yields like we had 3 years ago, bonds are now offering a slightly higher yield than stocks.

So from here we have three options:

1) We need a rapid reduction in rates to justify stock prices without stock prices going up. If this happens, bonds are better than stocks

2) We need a huge jump in earnings without rates or stocks going up. In this situation, bonds are better than stocks because of a higher yield.

3) We need stock prices to decline while rates stay the same. Again, here bonds are better than stocks.

That’s the logic. What happens in the short-term? Who knows. But right now isn’t a great time to buy stocks over bonds. Especially when CPI will be under 3% soon so real rates are positive and getting more positive and NVDA is at 200 times earnings and 40 times sales.