Falling Knives are Serrated

It’s been a tough start to the year. As noted on Jan 6, the music is fading. We had a nice intraday rally yesterday. Does that mean we are done? If you think stocks are in a bubble, we’re probably just getting started.

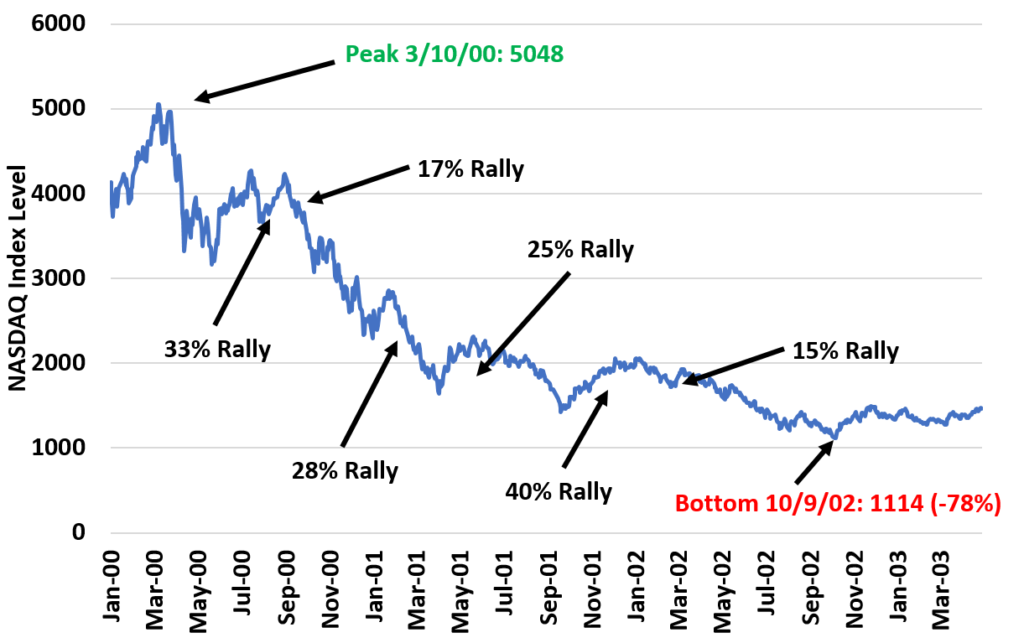

This is the NASDAQ from 2000 to 2003. I’ve labeled the top and the bottom and alllll of the significant rallies in between.

The NASDAQ peaked in March and quickly fell 30%. It then had over the next 18 months rallies of 33%, 17%, 28%, 25%, 40%, and 15% before finally bottoming in Oct 2002 down 78% from the peak.

The bottom line is that things don’t go down in a straight line when the bubble pops. Why?

- People confuse lower price with cheap and start buying. Rivian is down 42% this year. Is it cheap now?

- Shorts have to cover. Remember, bears make money. Bulls make money. Pigs get slaughtered.

I personally think many pandemic and tech oriented names are still pretty pricey so be careful.

But for sure, do not let emotions control your decisions. If you sell when we go down and buy after the rally, you will do horribly in any market. Especially a bear market.