Good News is Bad and Bad News is Bad

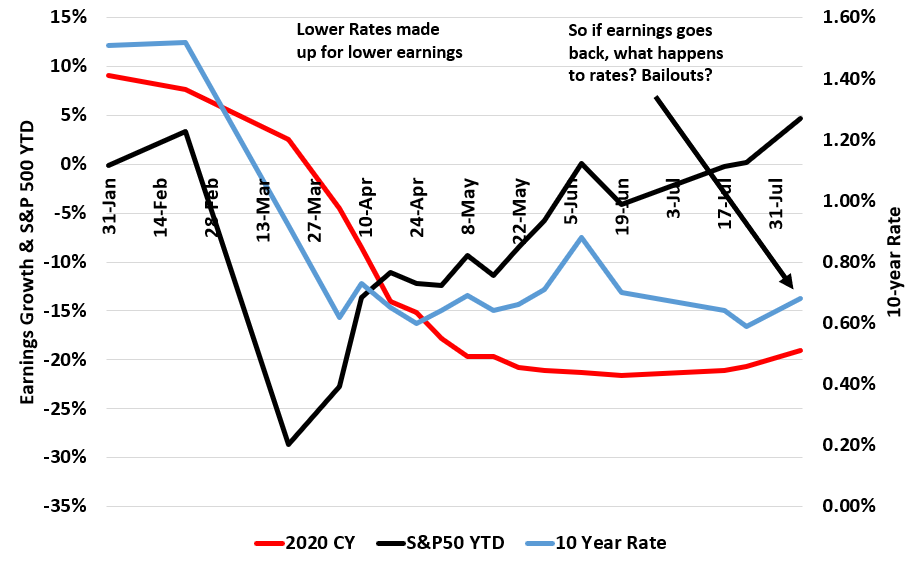

We are at that point in the markets where they are so high almost all news is probably bad news. Why do I say that? Here’s a graph of earnings growth expectations, the 10-year rate, and the S&P 500.

As you can see, when the crisis hit, earnings growth was hugely impacted, which brought down markets. However, the 10 year rate also crashed which helped markets.

But you can see what is happening today: Jobless claims are down but the market is too. Why? Because rates are up because the market is anticipating less Fed support.

The bottom line is good news will lead to higher rates which will lead to lower stock prices. Bad news will lead to lower growth and rates can’t go much lower.

The only way you get another huge rally is if earnings recovery and rates stay low. That seems unlikely.