Is the Casino Closing?

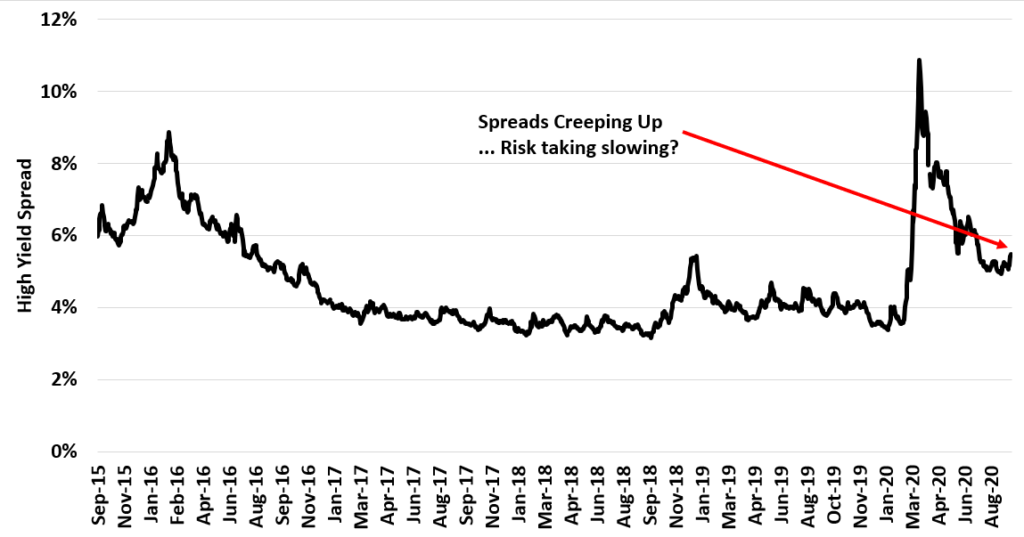

One interesting development the last couple weeks is the expanding high-yield (aka junk bonds) spread. Here’s the chart:

You can see the spread never made it down to the pre-COVID low. It’s starting to creep up a bit now.

If this continues, it is probably a big negative for equities. 1) It means people are becoming more risk-adverse and 2) stocks get paid after bonds. If there is a higher chance bonds don’t get paid, then there is a higher chance stocks are worthless.

Something to watch…