Market Betting Fed Blinks

The last few weeks the market has been rallying. The NASDAQ is still off 20% for the year, but it was down almost 30%. Why is the market doing so well? Simple: People are better the Fed will blink on rates.

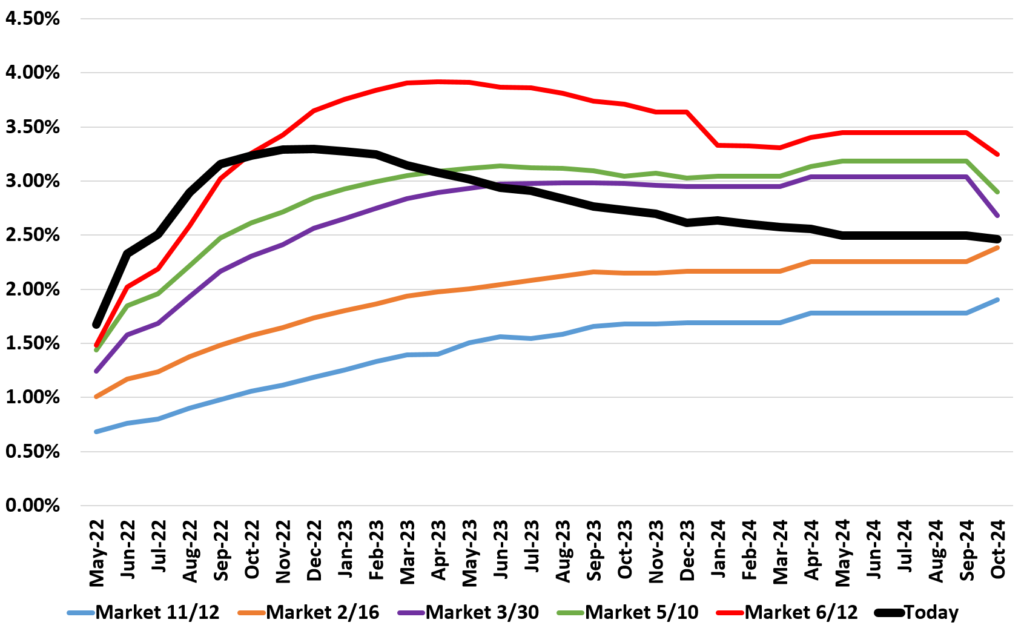

Here’s a graph of expectations about Fed Funds since last November. The black bar is expectations today.

As you can see, expectations were much higher on June 12 then they are today. It’s probably not a surprise the lows of the market were around mid-June.

The question is now: Is the market right? It’s hard to imagine we’ll peak at 3.25% on Fed Funds. The Fed is talking about a 75% hike in September, which puts us at 3.25% already.

While the market is pretty smart I can’t imagine these 4 things can all be true in the second half of the year:

- The Fed continues to raise rates

- Real GDP growth accelerates to 2.9% on average (needed for the Fed forecast)

- Inflation gets close to the Fed’s 2%

For inflation to go away, the economy – and specifically – the labor market has to cool significantly. How can that happen with GDP accelerating? Doesn’t make sense to me … but the market is smart.