No (New) Money, Mo Problems

I’m going to make a number of posts trying to explain why we have fiat currencies and why that is not necessary a problem. This first post explains why nothing of fixed supply will EVER be a currency in our modern economy – not Bitcoin, not litecoin, not worthlesscoin, not gold, not Mickey Mantle rookie cards.

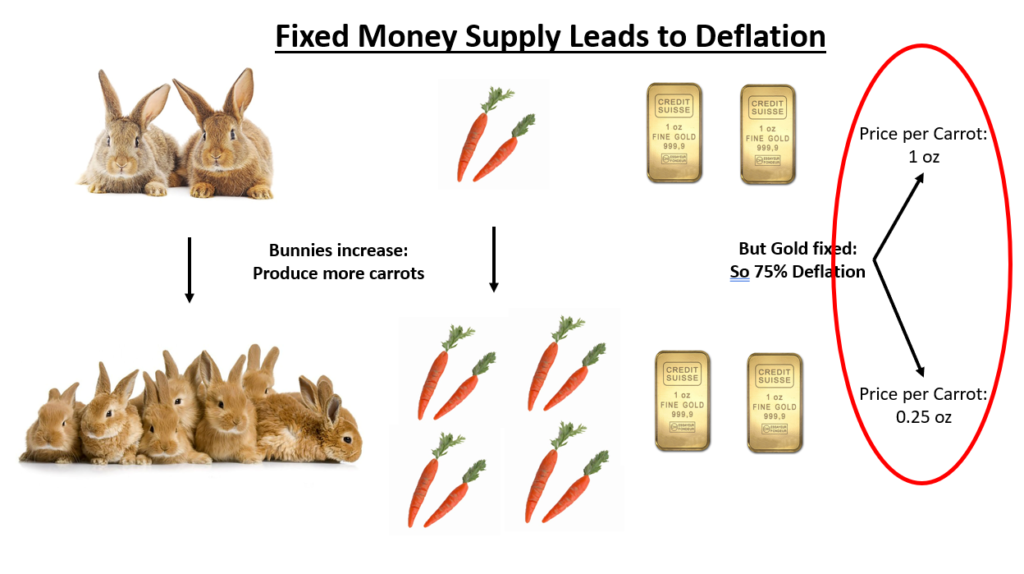

This picture sums it up.

Over time the number of people (bunnies) in the world increases. They produce more stuff (2 carrots to 8 carrots). This is ‘real’ growth. However, the supply of money stays the same – 2 oz of gold.

In the first period, the price of each carrot is 1 oz. In the second period, since the number of carrots are up, the price per carrot is now only 0.25 oz. AKA we just had deflation of 75%.

Deflation is the death of our economy. Why?

- All debt is in nominal terms. If the price of your house goes down and your salary goes down, eventually you will default on your loan. There goes the banking system (see 2008-09)

- If you know prices are going down next year, why buy today? If you know the price the following year will go down again, why buy? There goes demand.

Every time an economy – any economy – has gone on the gold standard it hasn’t last long. Just in the 20th Century in the US:

- During the Great Depression, the US government prohibited the ownership of physical gold (Executive Order 6102), then repossessed all of the Fed’s gold (Gold Reserve Act), and then proceeded to change the value of gold from $20.67 per oz to $35 an oz.

- After WWII, the world setup Bretton Woods. The dollar was pegged at $35/oz of gold. When we abandoned the standard in 1971, the US only had about 21% of the gold needed.

We will never go back on a fixed supply currency as the standard. It would devastate the economy.