Revisiting FAANG vs. NYSE

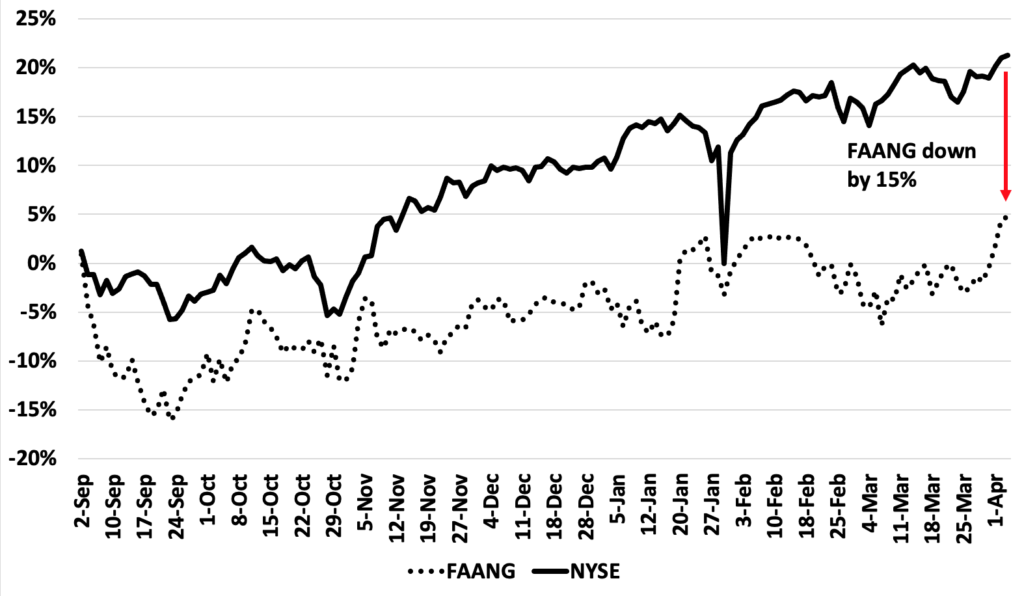

Back in September, I made a couple of posts (here, here) about how extrapolating the great FAANG returns from the prior 12 months would probably lead to underperformance and disappointment. Let’s see how that prediction worked.

FAANG stocks have underperformed by about 15% over the last 7 months. This is only natural after their huge run. The question is… will the underperformance continue?

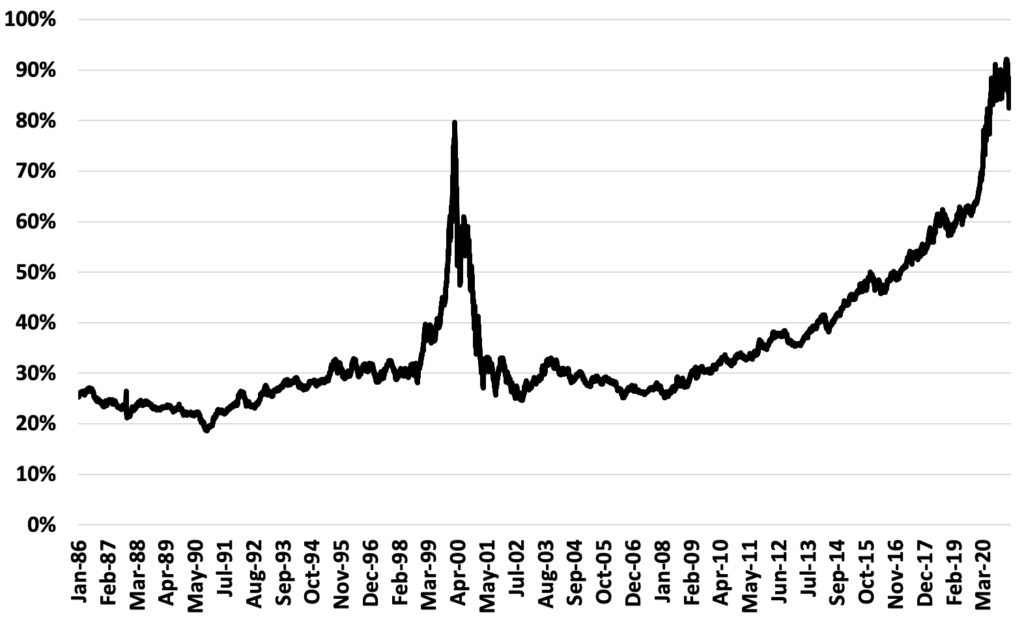

The ratio of the NASDAQ to NYSE is still elevated, which would imply continued underperformance of the NASDAQ. Note that FAANG stocks represent 31%of the NASDAQ 100 weights.

My expectation over the next few years is the NYSE – aka boring stocks – will do better than NASDAQ.