Risk On, Risk Off

I’ve posted several times the last few months about the market hitting a top. (1/6, 1/25, 1/31, etc.) This is especially true of NASDAQ and Tech (see RIVN for example). Unfortunately, it seems there is probably more pain to go.

There are no good things happening. Growth is slowing. We don’t have any workers left to stimulate growth. The Fed is going to be Uber aggressive. (And you NEVER fight the Fed). There is no more stimmy money coming.

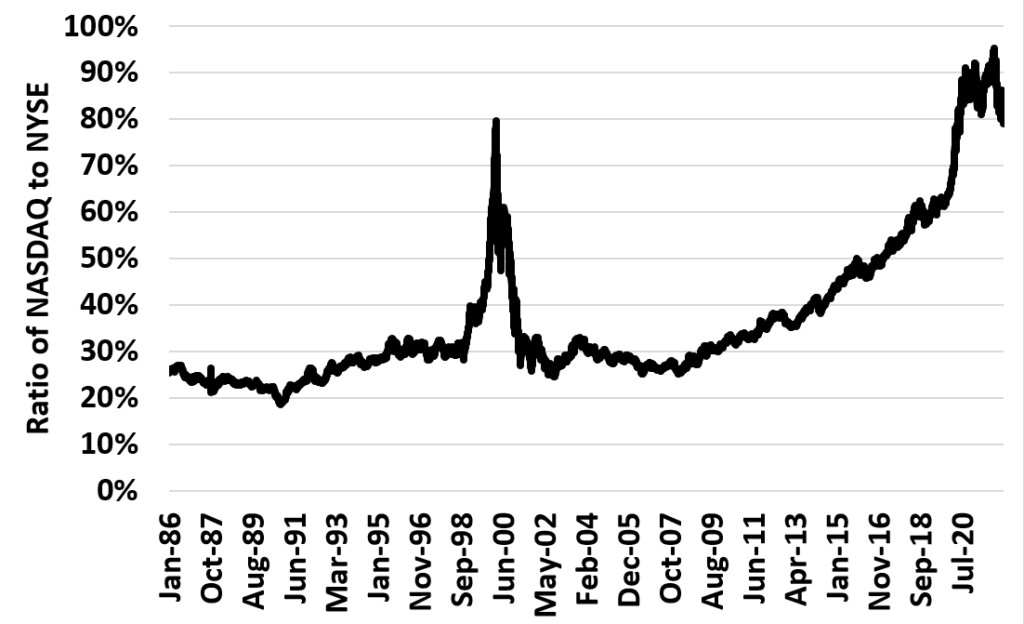

So what I am watching? I view today similar to 2000. We had a bunch of retail investors (and Cathie Wood) come into the market due to zero commissions and push up “sexy” stocks. We had everyone thinking tech growth was unlimited. And thus, the NASDAQ became unhinged to the rest of the market – just like 2000.

Here’s the updated version of the graph I’ve posted many times.

During the tech burst in 2000, the market bottomed a bit after this ratio came back to normal. Even if you view the pre-COVID number as the normal, we have a long way to go from here.

Will the market go straight down? No. But my guess is it will continue to work down until we get to a better equilibrium in this ratio.