Robinhood And DOGE Sitting in a Tree…

Rohinhood’s IPO documents were released yesterday and there are some interesting items. For example, they list investor interest in DOGEcoin as a business risk. Check out the graph below to see why.

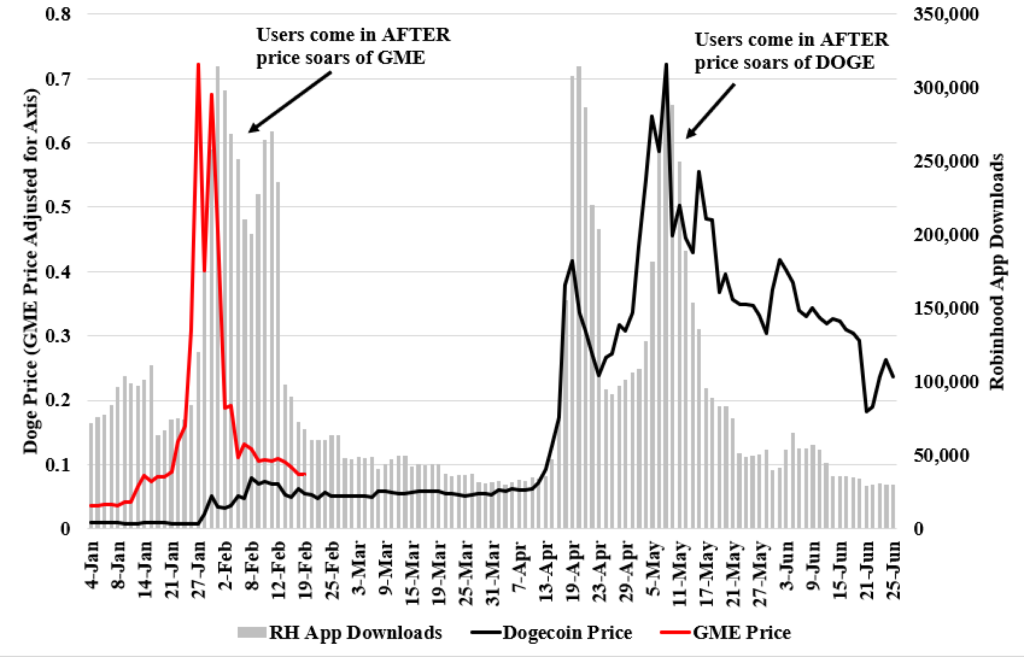

Here I’ve plotted the number of times the Rohinhood App is downloaded from the App store in 2021 (right axis/grey bars). I have then plotted the price of DOGEcoin as well as the price of GME re-scaled so both fit on the same axis (left).

Basically you can see that Robinhood App downloads soared around the time that DOGEcoin’s price soared. The same happened for GME. You can also see that the App downloads FOLLOWED the price increases. Thus, these new Robinhood investors likely bought high and lost money. (In fact, I estimate from DOGE they lost 40% already.)

Quite frankly, Robinhood’s business model relies greatly on crazy bubbles in some stock/crypto forming to sucker in Naive investors. If that ever stops, their growth will stop too.