No matter how much you love a company, Price Matters. It can be the best company in the world. It can even be destined to be the most valuable company in the world. Price is so important.

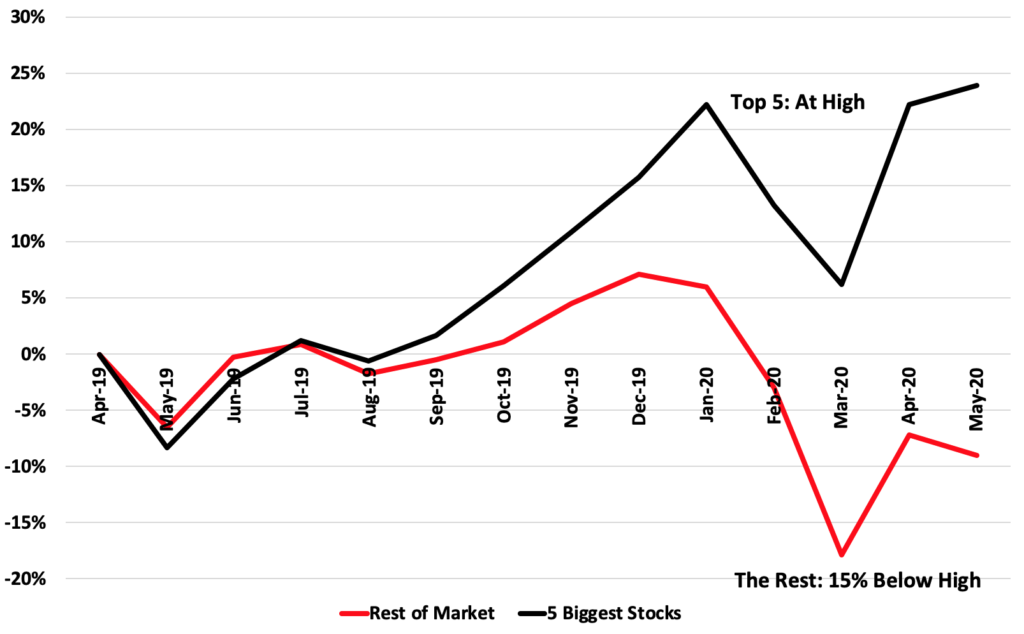

Here’s a chart for you:

This is AMZN. It went public in 1997 and peaked in 1999 at $106 a share. It took 10 years to get back to that share price. Inflation adjusted even longer. Of course today it is one, if not the top, market cap company in the world.

Today some stocks are pretty expensive. I’m not saying they are in a bubble. But…

TSLA may be the next AMZN…. but at a Market cap of $267 billion and a P/E of 776 maybe it’s a little ahead of itself.