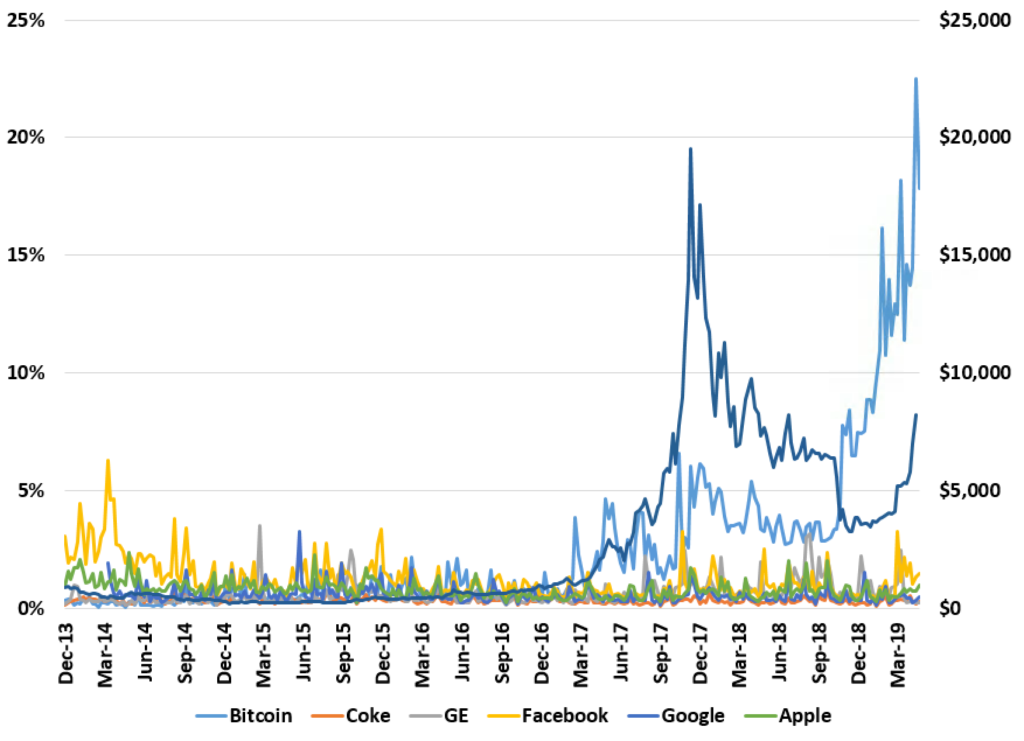

-9%, 0%, 4%, 3%, 6%. Those are the last 5 days of returns for Bitcoin. Just for some perspective the largest one day move for the USD in the last 3 years is… 1.6%.

While people are excited Bitcoin is back to around $20,000… it means the Bitcoin has earned 0% in returns over the last 3 years since the last peak. Bitcoin may have some value more than $0, but the market seems to have no idea what it is.

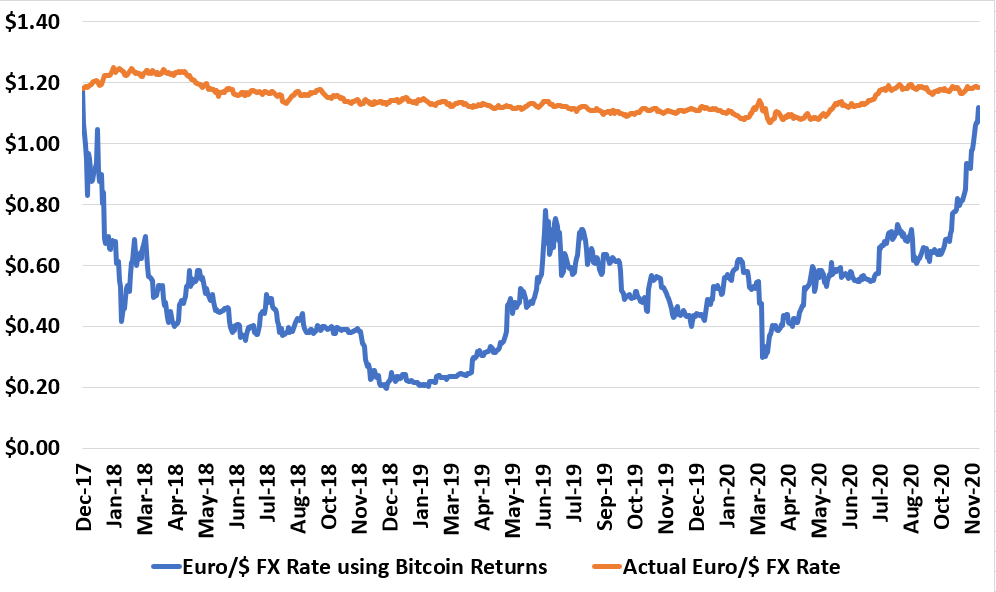

Just to show you how poorly Bitcoin fares as a “currency,” below is a graph of the actual Euro to Dollar exchange rate over the last 3 years. I then took the value of the Euro on the first day and applied Bitcoin’s returns over the last 3 years to show you what the Euro/$ exchange rate would be over that time if it was as volatile as Bitcoin.

I’m pretty sure that no one would what to experience that exchange rate volatility.