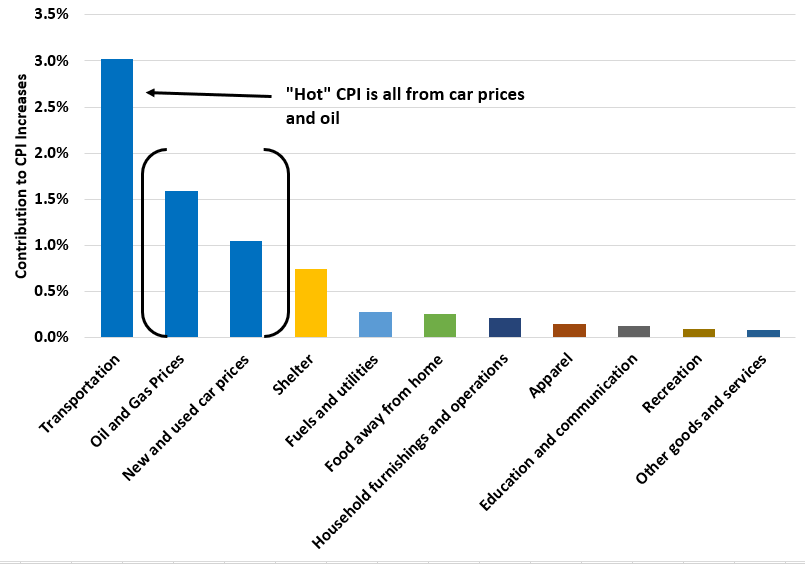

June CPI came out yesterday at 5.4% and people are freaking out. But they are missing that CPI is being driving simply by car prices (which people can skip buying) and oil price recovering. Outside that, CPI is up … 1.7%.

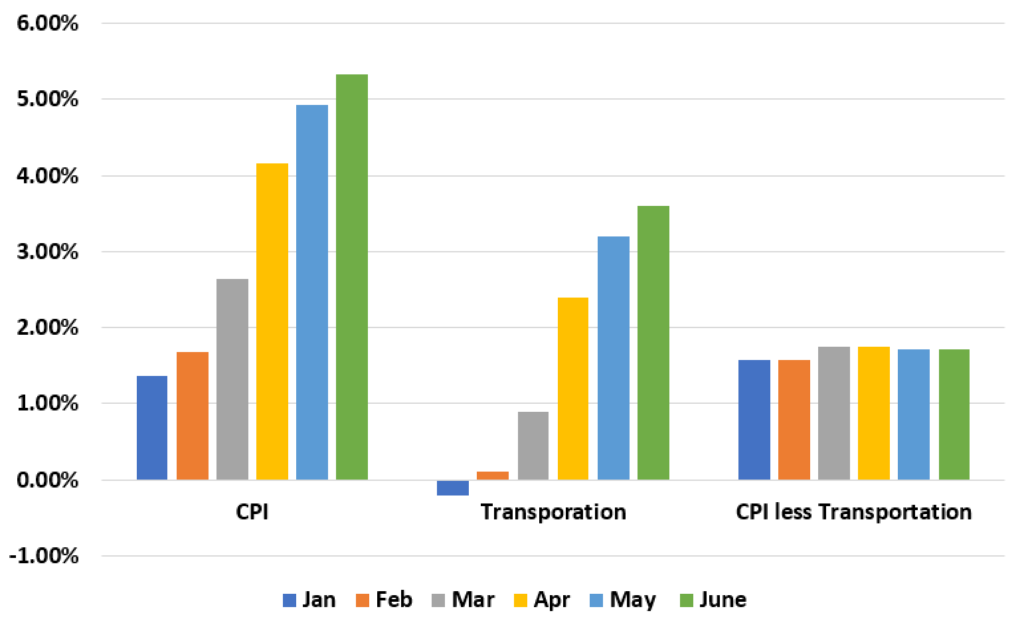

Here’s a chart showing CPI, the contribution of the transportation component, which is oil products and car prices, and then CPI minus transportation.

You can see that CPI has risen rapidly in 2021, but you can see if you remove the transportation component, CPI overall has stayed the same.

In other words, CPI is due to car prices and oil. Oil is at $70 a barrel – nothing crazy. It’s just up huge since the crash in 2020. (Remember when oil was -$32?)

Car prices are high because of a shortage of chips. People can put off buying a car (and probably are) and those prices will come back down.

The bottom line is so far this is just a transitory inflation issue. People are too panicked about the top line number.