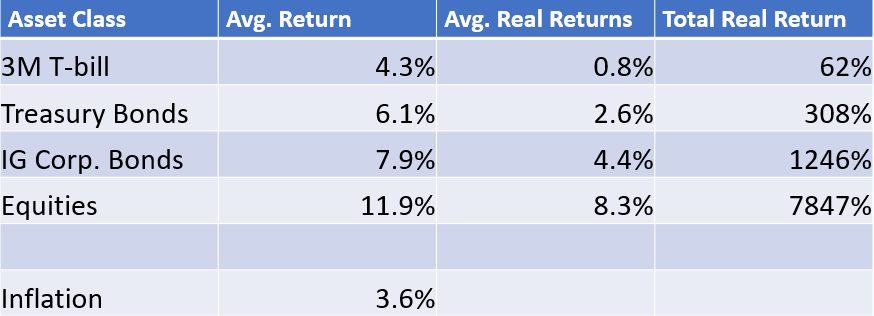

“The dollar has lost 90% of its value since 1955 – buy gold! Buy Bitcoin! You’ll lose the value of all your money.” This line of argument is garage – a lazily thought out sales pitch. In the lowest risk asset, you would have made a real return of 62% over that time period.

Here’s a table showing average yearly inflation as well as nominal and real returns for various asset classes since 1955 when Doc Brown thought up the Flux Capacitor.

That’s right. If you bought a boring 3 month T-bill as your only investment for the last 65 years you STILL would have more purchasing power today than 1955. If you got REALLY crazy and bought corporate bonds you’d only have 1246% more purchasing power.

Sure if you buried your money in the backyard the dollar lost 90% of its value. Although, it’s not that bad – you could sell those $1 silver certificates for $4 now on eBay.

Here’s the really bad news if you invest in 1 oz. of Gold or 1 Bitcoin etc. In 1,000 years, you will still only 1 oz of Gold or 1 Bitcoin. There are no dividends. There are no interest payments. There is no growth rate. The only way this works out for you is if there is negative real returns for the next 1,000 years. If that’s the case, you’ll probably be worried about more than inflation.