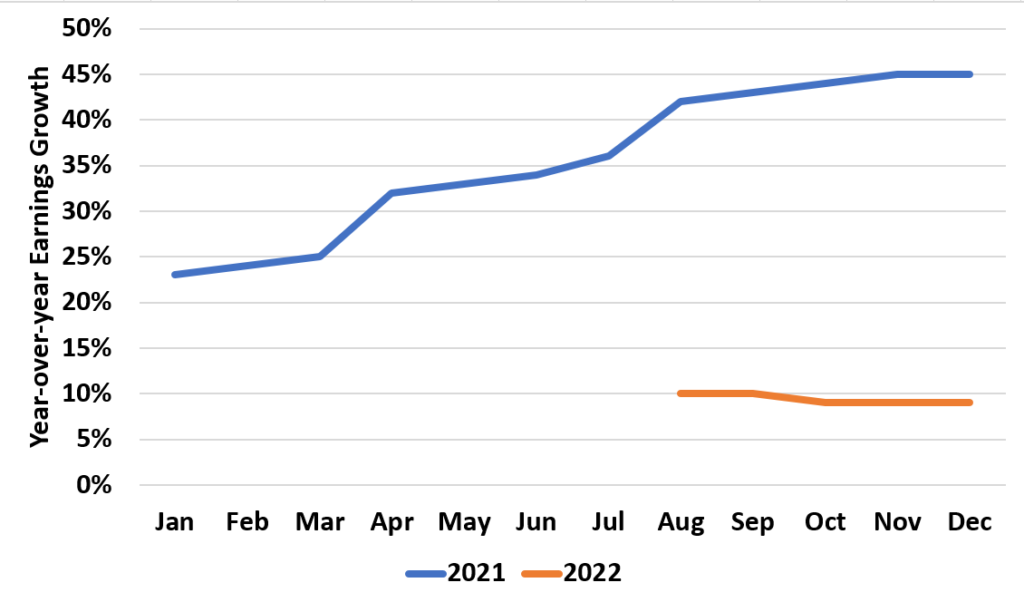

Why is the market up so much this year? People can talk easy money, Fed interest rates, the number of rainbows, who knows. This one graph tells you why. It’s expected earnings growth over the course of 2021.

Earnings growth expectations increased by over 20% during the course of the year.

Of course the question is what happens next year. With earnings growth at 9% and 3 Fed Rate hikes expected, I don’t think we’ll see such a tailwind in 2022.