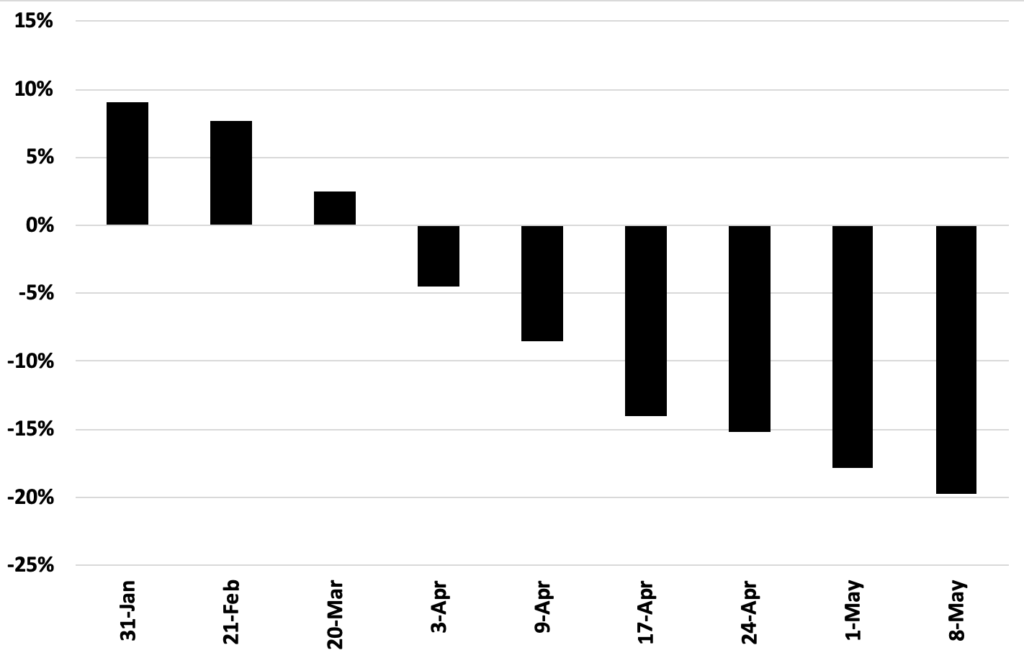

In January, I told you to rebalance to reduce equities. In March, I told you to rebalance to get longer equities. Today I’m telling you to make sure you rebalance again. Q2 Earnings Season is likely to cause a lot of volatility.

Why? Because analysts and the market really have no idea what earnings are going to be.

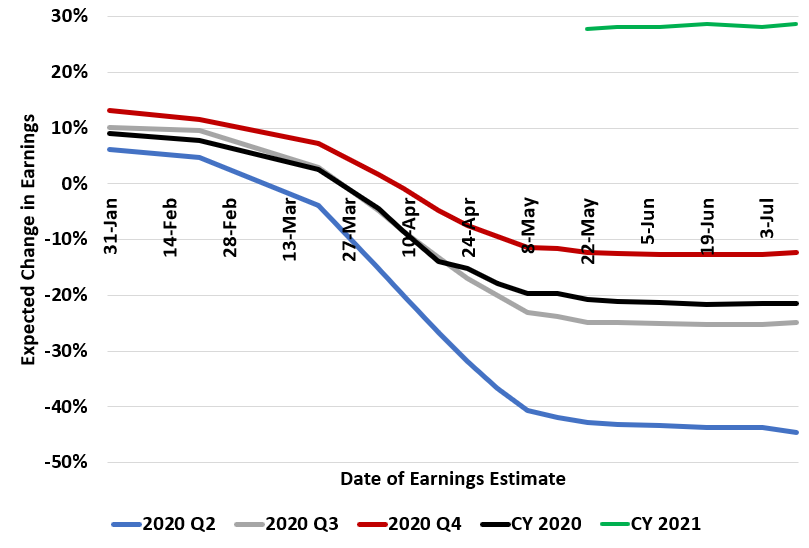

Here’s a chart showing the expected change in earnings over time from Factset Insight.

While you may look at the total lack of change since May as evidence we know EXACTLY what is going to happen, it’s really the opposite!

Most firms pulled guidance for the year. So analysts have nothing to go on. That will make earnings even more volatile than normal.

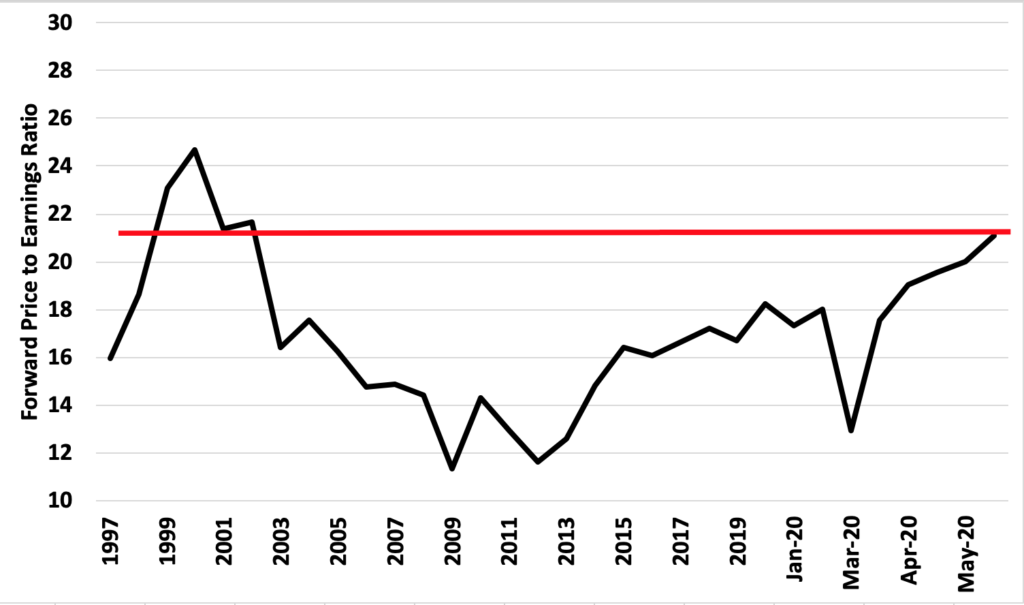

Given the market is close to all time highs, I think the “whisper” earnings expectations may be a little high for the rest of 2020 and 2021, which could led to a pullback. Especially in names with nosebleed valuations.