Some economists are suggesting Delta impacted the economy in Q3 as growth estimates have been cut from 10% to 4%. I just don’t see it. The problem is the economy has mostly recovered by end of Q2, reducing future growth possibilities.

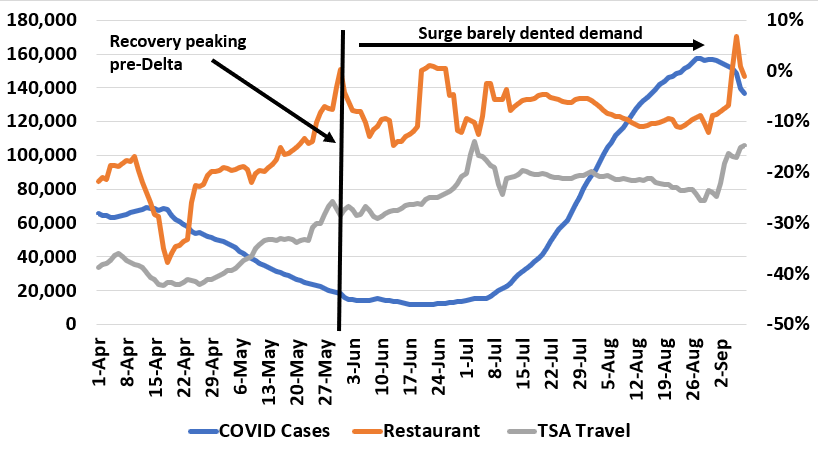

Here is a graph looking at COVID cases, restaurant attendance, and TSA passenger data starting in April.

Three things to note:

- As advertised 6 weeks ago, the Delta wave would probably peak in 3-5 weeks. It looks like it peaked last week.

- The recovery in restaurant and TSA data peaked well before the Delta surge started.

- Delta did not materially adversely impact demand for these services.

Overall, future economic growth in the US will be closer to the long-term trend. The days of 8% and 10% GDP growth are over. Additionally, it’s highly unlikely unless things get really crazy and there are lockdown again we see COVID impact demand materially.

The problem is on the other side of the aisle… I’ll get to that next week.