One of the most frequent questions I’ve been asked is about the residential housing market. Many people have memories of 2007-09 and think we will repeat it. However, I’ve been arguing the market will be fine given where the layoffs are happening.

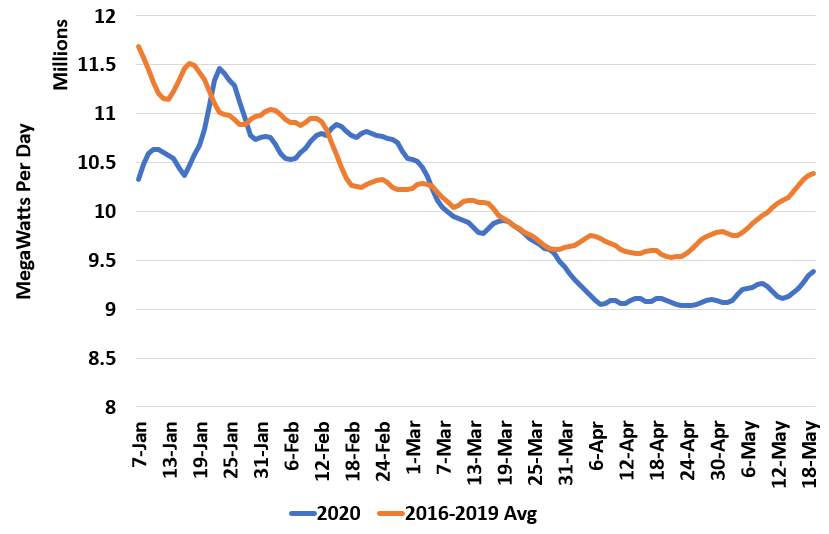

One early indication is looking at the number of mortgage applications. Here’s the data that came out today.

You can see that purchase applications are just about where they were last year and recovering quickly. Why? Most people that lost their job are probably not in the mortgage market.

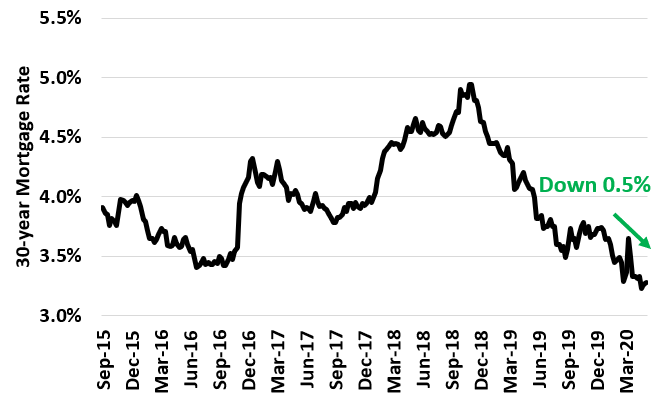

Additionally another item that has helped is mortgage rates. Here’s a graph of rates over the same time period.

They are down 0.50% since the beginning of the year and last year. While 0.5% doesn’t sound like much, all else equal the same mortgage payment will afford you 5% more house.

House prices will be something to watch this summer. Inventory is way down over last year, which could cause bidding wars.