Again, start thinking about what happens when things reopen. People only have so much time/money for things. Example: When my shoulder was injured I stopped playing golf and started biking. Got my shoulder fixed: No more biking.

Again, start thinking about what happens when things reopen. People only have so much time/money for things. Example: When my shoulder was injured I stopped playing golf and started biking. Got my shoulder fixed: No more biking.

I’m going to make a number of posts trying to explain why we have fiat currencies and why that is not necessary a problem. This first post explains why nothing of fixed supply will EVER be a currency in our modern economy – not Bitcoin, not litecoin, not worthlesscoin, not gold, not Mickey Mantle rookie cards.

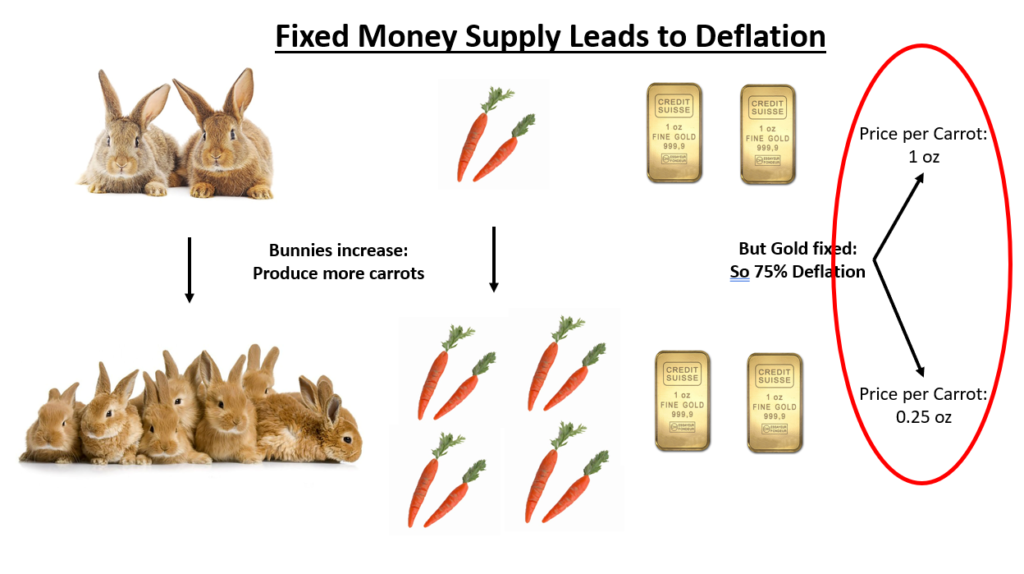

This picture sums it up.

Over time the number of people (bunnies) in the world increases. They produce more stuff (2 carrots to 8 carrots). This is ‘real’ growth. However, the supply of money stays the same – 2 oz of gold.

In the first period, the price of each carrot is 1 oz. In the second period, since the number of carrots are up, the price per carrot is now only 0.25 oz. AKA we just had deflation of 75%.

Deflation is the death of our economy. Why?

Every time an economy – any economy – has gone on the gold standard it hasn’t last long. Just in the 20th Century in the US:

We will never go back on a fixed supply currency as the standard. It would devastate the economy.