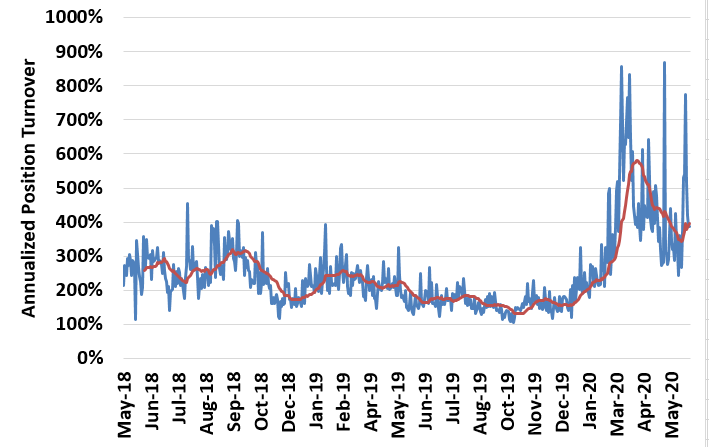

Yesterday I documented that the number of Robinhood accounts has soared. Here is the annualized position turnover of Robinhood users.

Before this year, position turnover was somewhere around 100-200%, which is not that much different than most actively managed mutual funds.

However, since March, turnover has soared – hitting close to 1000% annualized. Today the 30 day average is close to 400%.

Again, this is not investing. This is trading. We’ll see later whether the RH users or the house is winning.