That is one of my favorite quotes from The Big Short. Right now, that is happening to a lot of Robinhood traders. This article discusses someone who borrowed $45,000 from his house and credit cards and pretty much lost it all.

Robinhood users are making the classic “past returns predict future performance” mistake.

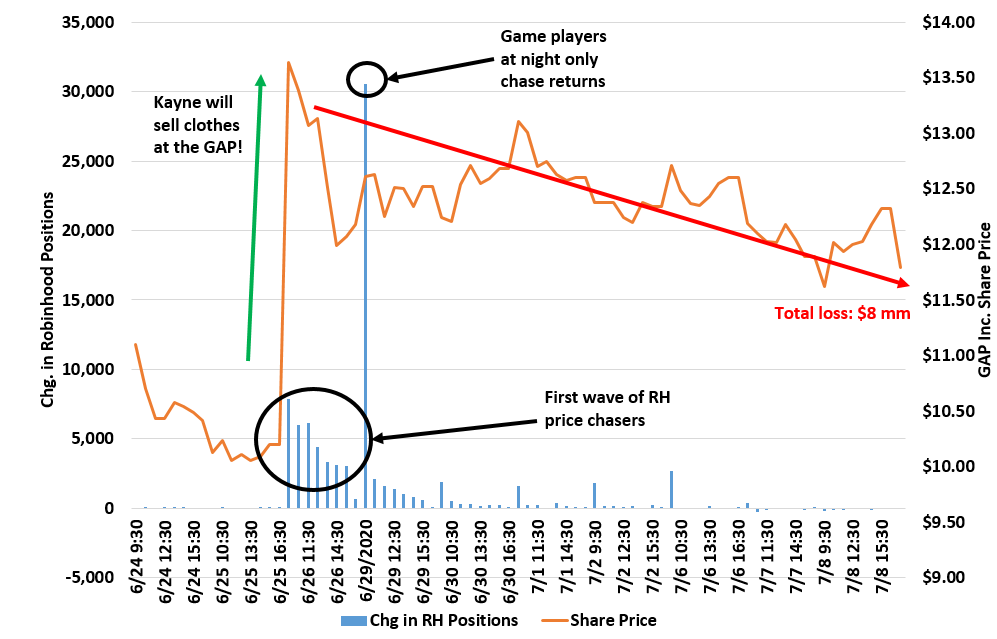

Here’s an example. This is Gap Inc. (Ticker GPS). On June 26th, it was announced that Kanye West’s clothes would be sold at the Gap. (I assume they say “Kanye 2020” on them.)

This graph has the share price and change in the number of Robinhood positions by hour.

Gap Inc. quickly rose almost 30% on the news. You can see how Robinhood uses that “play the game” during the day immediately started buying.

The next morning, there was a HUGE surge in buying. (This is typical – most RH trades are at the open. You can see the spike almost every morning.) I assume many Robinhood users look at things at night and put in buy orders for the open. That probably causes price pressure.

Finally interest died and now all of those new owners – 700% higher than before the news broke – are probably sitting on loses of approximately $8 million if I assume trades of 100 shares per trade.

Bottom line: Buying after a huge gain like this is almost a losing proposition. However, it’s how RH users like to play the game. And now they are paying for it.