The Fed just paused it’s rate increases, but the market is taking it on the chin. Why? The Fed signaled two more rate increases are coming this year. As I’ve been saying, the market isn’t going to get good growth AND rate cuts.

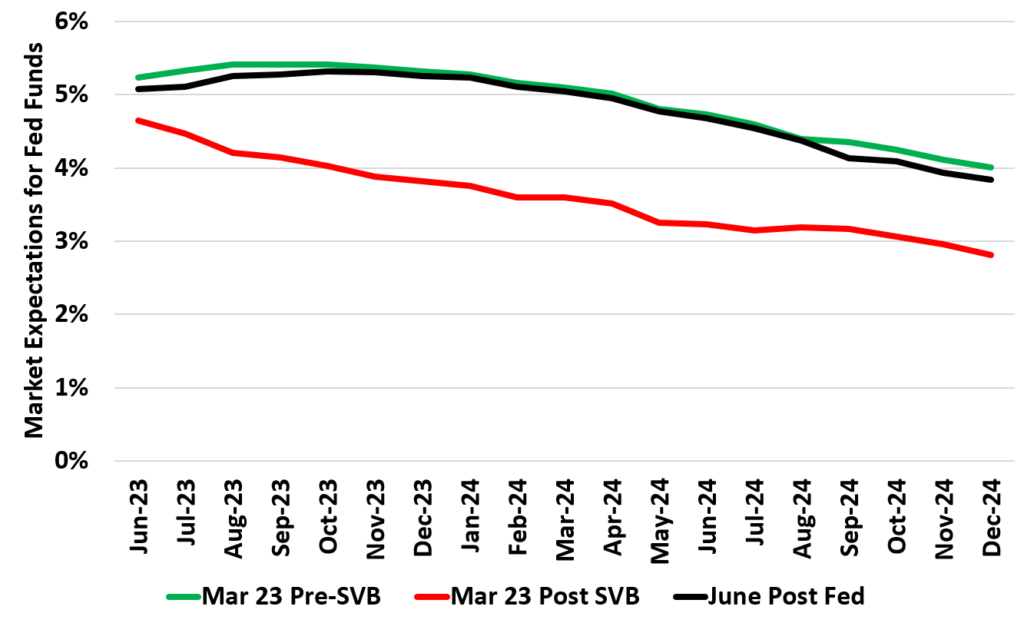

Here’s the progression of Fed Fund’s expectations this year. I have plotted expectations back in march prior to SIVB blowing up, right after, and now after the Fed meeting.

After SIVB blew up, the market thought the Fed was done and anticipated 3 or 4 cuts by the end of the year. Now? We’re back where we started before the banking issues. The market is expecting another hike or two and then no cuts before the end of the year.

If the labor market and economy stay strong, then the Fed is going to raise more. The market isn’t going to get good earnings growth and Fed rate cuts. Which is why I don’t see a strong market the second half of the year.