The 2nd Fed meeting of the year is coming up. People are wondering if the Fed will raise rates by 0.25% or more aggressive and raise rates by 0.50%. The Fed I’m sure would love to do only 0.25%, but they are way behind.

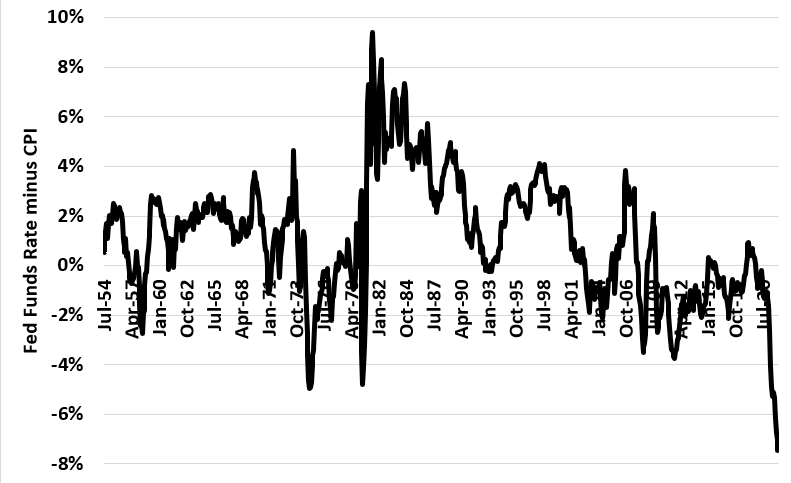

How far behind? This graph is the difference between the Fed Funds rate and the CPI. Yes, CPI is backward looking, but … it’s not a good look.

You can see the difference has never been more negative. In other words, the Fed has NEVER been farther behind. Not in 1973. Not in 1979. Not ever.

The markets and economy better hope inflation subsides quickly. Otherwise the Fed is going to be forced to act very, very quickly.