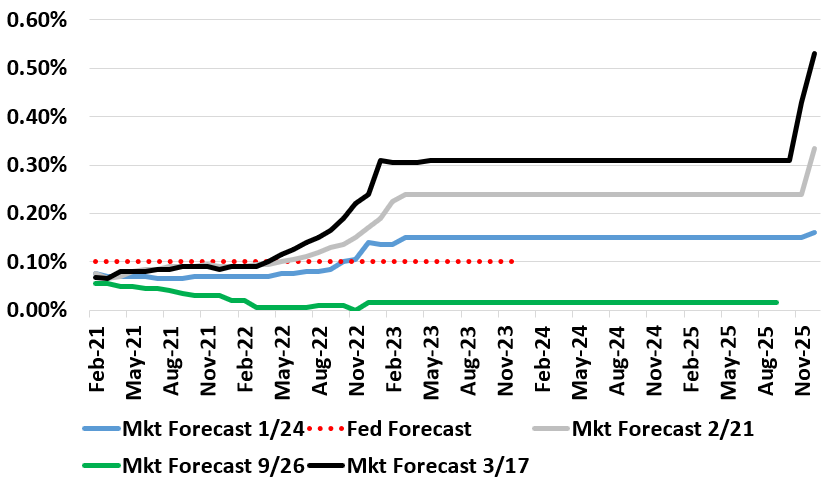

The Fed just came out and suggests they don’t plan on raising rates until 2024 at the earliest. The market seems to not believe them. Here’s the Market’s Fed Fund’s forecast as it progresses through 2021 vs. the Fed’s forecast.

The market shows a 100% chance the fund will raise rates by Jan 2023. In fact, you can see the Market has become more convinced rates will go up in 2023 over the course of the year.

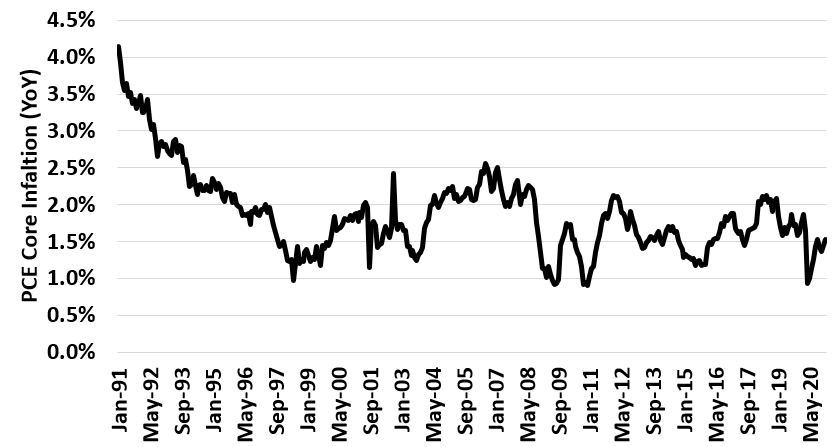

The question is who is right. Historical expense says it’s the market. The Fed has some work to do to convince the market otherwise give they are forecasting 2.4% inflation this year.