The Fed came out today and say they are going to look at average inflation over time. So if inflation is below 2% this year it can be a bit above 2% next year. People are taking this to mean the Fed almost will never raise rates.

Well, that is kind of true. But it’s not because we don’t measure inflation above 2%. it’s because of the inflation measure the Fed prefers.

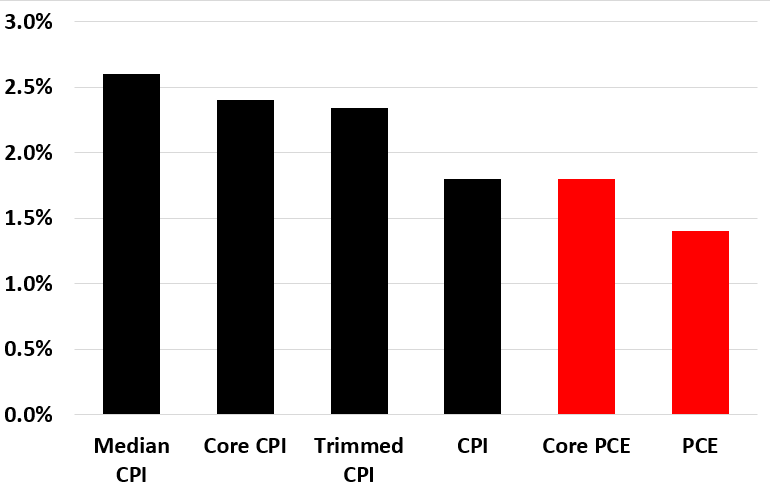

This is a graph looking at the average rate of inflation in the U.S. over the last three decades.

Median CPI, Core CPI, and Trimmed CPI are all different ways to try to remove volatile outliers from the data. In all 3 cases, the average inflation rate is more than 2%.

CPI includes everything – food and energy unlike core CPI . It’s less than 2%.

PCE is another way to measure inflation. The Core value over the last 3 decades is 1.8%. For the other core inflation measures, it’s 2.3% – 2.6%. Thus, PCE runs about 0.5% to 0.6% lower than other inflation measures.

Guess which one the Fed likes?