10-year rate down 0.50%. 5-year inflation expectations down 0.30%. 10-year minus 2-year – an indicator of future growth – is down almost 0.50%. What does it all mean? The market is reining in growth expectations … perhaps due to a government spending hangover.

While people are focused on the Fed, they have their eyes on the wrong ball as the cause.

The real cause? We may have a huge decline in Government spending next year. Last year Government spending increased by almost 50% – THE MOST SINCE WORLD WAR II. What happened when the stimulus stopped in 1945/6/7? The economy had a huge hangover.

Here’s annual economy growth since 1930.

Once that stimulus stopped, the economy slowed down too.

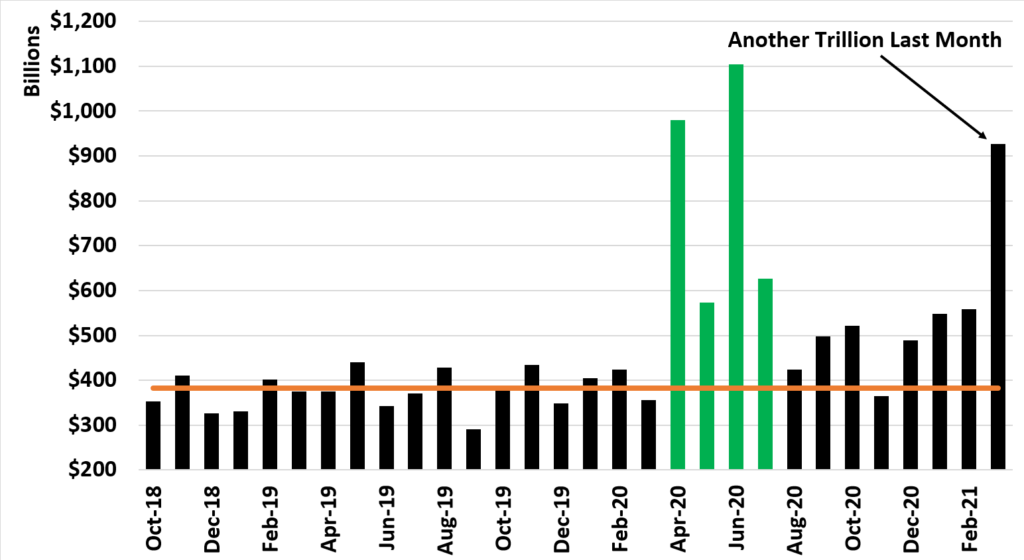

To keep up last year’s spending the Government needs some big time permanent spending increases. Those were coming in the form of two “infrastructure” bills. The first was set to be $2 trillion. The second was set to be the “American Families Plan” – another $1.8 trillion. In total: $4 trillion. Not all this year, but enough to have government spending stay at the $6 trillion level for the next few years.

But now… that’s not so likely. The $2 trillion infrastructure bill is down to $1.2… and only $579 billion is new spending. The American Families Plan is on hold.

Thus, spending next year is set to decline significantly, which will be a big drag on the economy.