Although the market thinks the Fed is done raising rates (or perhaps on a long pause), monetary policy is *FINALLY* getting restrictive. And my guess is it will get much more restrictive the next few months.

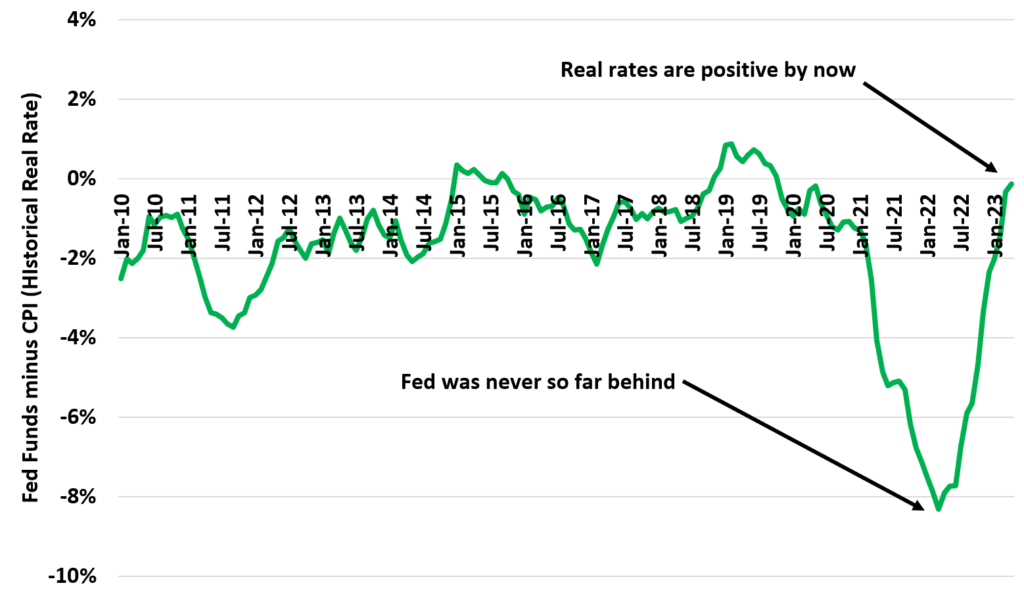

Here is a graph of Fed Funds minus CPI. Now, you can argue this is backward looking, but it gives a good feel about how restrictive monetary policy is/was.

Back in early 2022, the Fed was NEVER so far behind. Real rates were -8%. Of course, the Fed has now raised rates to 5% and inflation has began to come in. In fact it was under 5% last month.

The next few months we’ll see CPI fall farther as shelter comes in and lowers headline CPI and real rates will go even more positive. In fact, they may go the most positive they’ve been in the last 25 years.

The trillions of dollar question is whether positive real rates will cool the labor market or not. If not, the Fed is going to have to push on rates more. If they do, we’ll see a significant softening of the economy going forward even if the Fed does nothing.

Regardless, I would expect the beginning of 2024 to feature a fairly soft if not recessionary economy.