Over the last 2 months, we’ve see the stock market rally. Yet we have seen unemployment spike to levels not seen since the Great Depression. Why are the financial markets so rosy? It comes down to benefits and Moral Hazard.

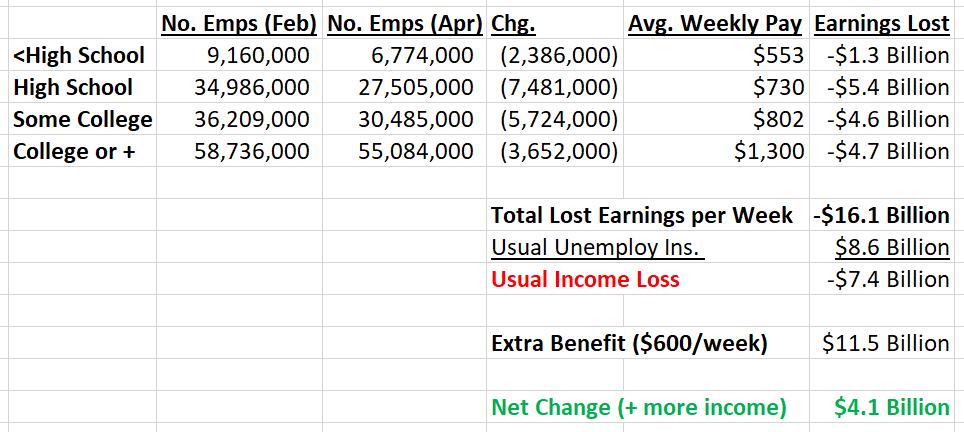

In this table, I provide data on education level, average weekly earnings, lost wages, and then the extra stimulus benefits.

First, this shows the power of education. You make way more money AND you have a lower chance of losing your job.

In the first month, you can see that most of the job losses were for those people without a collect degree. Those individuals, on average, make about $700 per week. Combining the job losses and average weekly earnings, the lost to the economy was $16.1 Billion per week by mid-April.

Now some of that is made up for at the state level. Typically unemployment insurance caps out at about $450 (depends on the state). That means $8.6 Billion would be paid to these workers each week, so the loss to the economy would be $7.5 billion.

However, Congress is giving $600 extra per week to those unemployed because of the crisis. That is an extra benefit of $11.5 billion, which means, in aggregate, laid off employees are making about $4 billion MORE per week that when they were employed.

Therefore:

- These workers have more to spend

- Many of these workers have no incentive to go back to work

So why is the stock market doing well? Because if we can get the economy going before the end of July, aggregate demand will Increase!

The moral hazard is the fact that people are better off NOT working. That is just bad incentives.