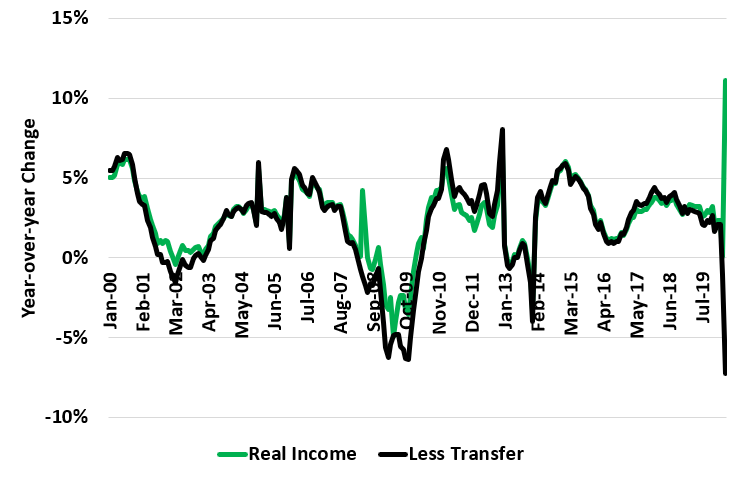

As noted a few days ago, the benefits provided by the government so far have likely more than offset the loss in income by consumers. Today’s data on real incomes show that more clearly. Here’s the data.

Usually changes in real income and real income minus transfer payments are about the same. Not in April.

Real Income went UP 11% while Real Income minus transfer payments went DOWN 7%. Thus, the government stimulus so far has more than offset lost wages.

This should last until at least through May as the extra $600 per week lasts until July and people are still getting their $1,200 checks. It’s likely to last after that as well as Congress appears posed to pass even more relief in the next few weeks.